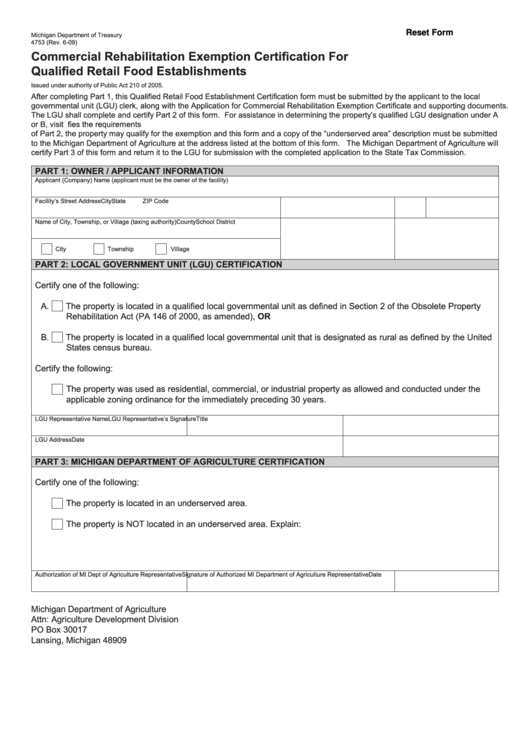

Reset Form

Michigan Department of Treasury

4753 (Rev. 6-09)

Commercial Rehabilitation Exemption Certification For

Qualified Retail Food Establishments

Issued under authority of Public Act 210 of 2005.

After completing Part 1, this Qualified Retail Food Establishment Certification form must be submitted by the applicant to the local

governmental unit (LGU) clerk, along with the Application for Commercial Rehabilitation Exemption Certificate and supporting documents.

The LGU shall complete and certify Part 2 of this form. For assistance in determining the property’s qualified LGU designation under A

or B, visit and click on Commercial Rehabilitation Act. If the LGU certifies the requirements

of Part 2, the property may qualify for the exemption and this form and a copy of the “underserved area” description must be submitted

to the Michigan Department of Agriculture at the address listed at the bottom of this form. The Michigan Department of Agriculture will

certify Part 3 of this form and return it to the LGU for submission with the completed application to the State Tax Commission.

PART 1: OWNER / APPLICANT INFORMATION

Applicant (Company) Name (applicant must be the owner of the facility)

Facility’s Street Address

City

State

ZIP Code

Name of City, Township, or Village (taxing authority)

County

School District

City

Township

Village

PART 2: LOCAL GOVERNMENT UNIT (LGU) CERTIFICATION

Certify one of the following:

A.

The property is located in a qualified local governmental unit as defined in Section 2 of the Obsolete Property

Rehabilitation Act (PA 146 of 2000, as amended), OR

B.

The property is located in a qualified local governmental unit that is designated as rural as defined by the United

States census bureau.

Certify the following:

The property was used as residential, commercial, or industrial property as allowed and conducted under the

applicable zoning ordinance for the immediately preceding 30 years.

LGU Representative Name

LGU Representative’s Signature

Title

LGU Address

Date

PART 3: MICHIGAN DEPARTMENT OF AGRICULTURE CERTIFICATION

Certify one of the following:

The property is located in an underserved area.

The property is NOT located in an underserved area. Explain:

Authorization of MI Dept of Agriculture Representative

Signature of Authorized MI Department of Agriculture Representative

Date

Michigan Department of Agriculture

Attn: Agriculture Development Division

PO Box 30017

Lansing, Michigan 48909

1

1