Form Pit-5 - New Mexico Qualified Business Facility Rehabilitation Credit

ADVERTISEMENT

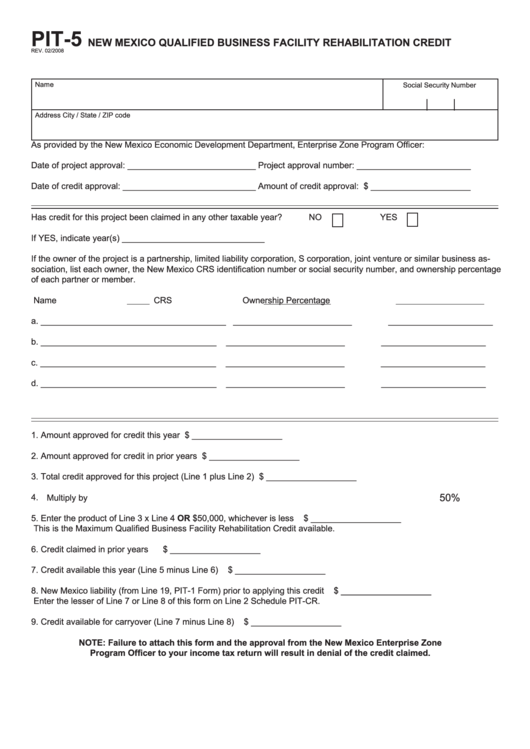

PIT-5

NEW MEXICO QUALIFIED BUSINESS FACILITY REHABILITATION CREDIT

REV. 02/2008

Name

Social Security Number

Address

City / State / ZIP code

As provided by the New Mexico Economic Development Department, Enterprise Zone Program Officer:

Date of project approval: ___________________________

Project approval number: ________________________

Date of credit approval: ____________________________

Amount of credit approval: $ _____________________

Has credit for this project been claimed in any other taxable year?

NO

YES

If YES, indicate year(s) ______________________________

If the owner of the project is a partnership, limited liability corporation, S corporation, joint venture or similar business as-

sociation, list each owner, the New Mexico CRS identification number or social security number, and ownership percentage

of each partner or member.

Name

CRS I.D. Number

Ownership Percentage

a. _______________________________________ _________________________

______________________

b. _____________________________________

_________________________

______________________

c. _____________________________________

_________________________

______________________

d. _____________________________________

_________________________

______________________

1. Amount approved for credit this year ..................................................................................... $ ___________________

2. Amount approved for credit in prior years .............................................................................. $ ___________________

3. Total credit approved for this project (Line 1 plus Line 2) ...................................................... $ ___________________

50%

4.

Multiply by .............................................................................................................................

5. Enter the product of Line 3 x Line 4 OR $50,000, whichever is less ...................................

$ ___________________

This is the Maximum Qualified Business Facility Rehabilitation Credit available.

6. Credit claimed in prior years ................................................................................................

$ ___________________

7. Credit available this year (Line 5 minus Line 6) ...................................................................

$ ___________________

8. New Mexico liability (from Line 19, PIT-1 Form) prior to applying this credit .......................

$ ___________________

Enter the lesser of Line 7 or Line 8 of this form on Line 2 Schedule PIT-CR.

9. Credit available for carryover (Line 7 minus Line 8) ............................................................

$ ___________________

NOTE: Failure to attach this form and the approval from the New Mexico Enterprise Zone

Program Officer to your income tax return will result in denial of the credit claimed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1