Print and Reset Form

Reset Form

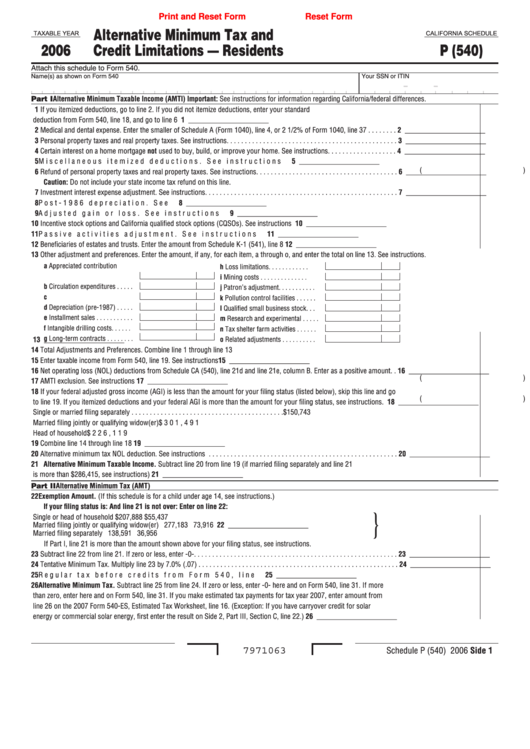

Alternative Minimum Tax and

TAXABLE YEAR

CALIFORNIA SCHEDULE

2006

Credit Limitations — Residents

P (540)

Attach this schedule to Form 540.

Name(s) as shown on Form 540

Your SSN or ITIN

-

-

Part I Alternative Minimum Taxable Income (AMTI) Important: See instructions for information regarding California/federal differences.

� If you itemized deductions, go to line 2. If you did not itemize deductions, enter your standard

deduction from Form 540, line 18, and go to line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . � ______________________

2 Medical and dental expense. Enter the smaller of Schedule A (Form 1040), line 4, or 2 1/2% of Form 1040, line 37 . . . . . . . . 2 ______________________

3 Personal property taxes and real property taxes. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 ______________________

4 Certain interest on a home mortgage not used to buy, build, or improve your home. See instructions . . . . . . . . . . . . . . . . . . . 4 ______________________

5 Miscellaneous itemized deductions. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 ______________________

(

)

6 Refund of personal property taxes and real property taxes. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 ______________________

Caution: Do not include your state income tax refund on this line.

7 Investment interest expense adjustment. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 ______________________

8 Post-1986 depreciation. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 ______________________

9 Adjusted gain or loss. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 ______________________

�0 Incentive stock options and California qualified stock options (CQSOs). See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . �0 ______________________

�� Passive activities adjustment. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . �� ______________________

�2 Beneficiaries of estates and trusts. Enter the amount from Schedule K-1 (541), line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . �2 ______________________

�3 Other adjustment and preferences. Enter the amount, if any, for each item, a through o, and enter the total on line 13. See instructions.

a Appreciated contribution

h Loss limitations . . . . . . . . . . . .

carryover . . . . . . . . . . . . . . . . .

i

Mining costs . . . . . . . . . . . . . .

b Circulation expenditures . . . . .

j

Patron’s adjustment. . . . . . . . . . .

c Depletion . . . . . . . . . . . . . . . . .

k Pollution control facilities . . . . . .

d Depreciation (pre-1987) . . . . .

l

Qualified small business stock. . .

e Installment sales . . . . . . . . . . .

m Research and experimental . . . . .

f

Intangible drilling costs . . . . . .

n Tax shelter farm activities . . . . . .

g Long-term contracts . . . . . . . .

o Related adjustments . . . . . . . . . .

�3 ______________________

�4 Total Adjustments and Preferences. Combine line 1 through line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . �4 ______________________

�5 Enter taxable income from Form 540, line 19. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . �5 ______________________

�6 Net operating loss (NOL) deductions from Schedule CA (540), line 21d and line 21e, column B. Enter as a positive amount. . �6 ______________________

(

)

�7 AMTI exclusion. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . �7 ______________________

�8 If your federal adjusted gross income (AGI) is less than the amount for your filing status (listed below), skip this line and go

(

)

to line 19. If you itemized deductions and your federal AGI is more than the amount for your filing status, see instructions.

�8 ______________________

Single or married filing separately . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $150,743

Married filing jointly or qualifying widow(er) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $301,491

Head of household . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $226,119

�9 Combine line 14 through line 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . �9 ______________________

20 Alternative minimum tax NOL deduction. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 ______________________

2� Alternative Minimum Taxable Income . Subtract line 20 from line 19 (if married filing separately and line 21

is more than $286,415, see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2� ______________________

Part II Alternative Minimum Tax (AMT)

22 Exemption Amount . (If this schedule is for a child under age 14, see instructions.)

If your filing status is:

And line 2� is not over:

Enter on line 22:

}

Single or head of household

$207,888

$55,437

Married filing jointly or qualifying widow(er)

277,183

73,916

22 ______________________

Married filing separately

138,591

36,956

If Part I, line 21 is more than the amount shown above for your filing status, see instructions.

23 Subtract line 22 from line 21. If zero or less, enter -0-. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23 ______________________

24 Tentative Minimum Tax. Multiply line 23 by 7.0% (.07) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24 ______________________

25 Regular tax before credits from Form 540, line 20. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25 ______________________

26 Alternative Minimum Tax . Subtract line 25 from line 24. If zero or less, enter -0- here and on Form 540, line 31. If more

than zero, enter here and on Form 540, line 31. If you make estimated tax payments for tax year 2007, enter amount from

line 26 on the 2007 Form 540-ES, Estimated Tax Worksheet, line 16. (Exception: If you have carryover credit for solar

energy or commercial solar energy, first enter the result on Side 2, Part III, Section C, line 22.). . . . . . . . . . . . . . . . . . . . . . . . 26 ______________________

Schedule P (540) 2006 Side �

7971063

1

1 2

2