WARNING:

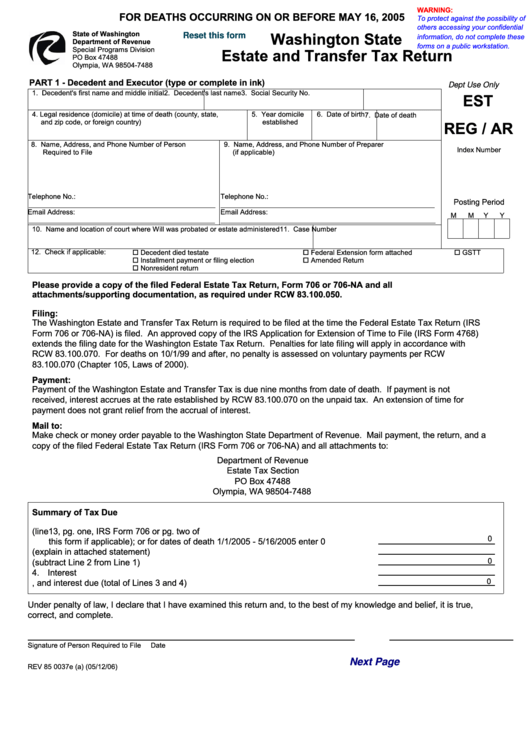

FOR DEATHS OCCURRING ON OR BEFORE MAY 16, 2005

To protect against the possibility of

others accessing your confidential

State of Washington

Washington State

Reset this form

information, do not complete these

Department of Revenue

forms on a public workstation.

Special Programs Division

Estate and Transfer Tax Return

PO Box 47488

Olympia, WA 98504-7488

PART 1 - Decedent and Executor (type or complete in ink)

Dept Use Only

1. Decedent's first name and middle initial

2. Decedent's last name

3. Social Security No.

EST

4. Legal residence (domicile) at time of death (county, state,

5. Year domicile

6. Date of birth

7. Date of death

and zip code, or foreign country)

established

REG / AR

8. Name, Address, and Phone Number of Person

9. Name, Address, and Phone Number of Preparer

Index Number

Required to File

(if applicable)

Telephone No.:

Telephone No.:

Posting Period

Email Address:

Email Address:

M

M

Y

Y

10. Name and location of court where Will was probated or estate administered

11. Case Number

12. Check if applicable:

Decedent died testate

Federal Extension form attached

GSTT

Installment payment or filing election

Amended Return

Nonresident return

Please provide a copy of the filed Federal Estate Tax Return, Form 706 or 706-NA and all

attachments/supporting documentation, as required under RCW 83.100.050.

Filing:

The Washington Estate and Transfer Tax Return is required to be filed at the time the Federal Estate Tax Return (IRS

Form 706 or 706-NA) is filed. An approved copy of the IRS Application for Extension of Time to File (IRS Form 4768)

extends the filing date for the Washington Estate Tax Return. Penalties for late filing will apply in accordance with

RCW 83.100.070. For deaths on 10/1/99 and after, no penalty is assessed on voluntary payments per RCW

83.100.070 (Chapter 105, Laws of 2000).

Payment:

Payment of the Washington Estate and Transfer Tax is due nine months from date of death. If payment is not

received, interest accrues at the rate established by RCW 83.100.070 on the unpaid tax. An extension of time for

payment does not grant relief from the accrual of interest.

Mail to:

Make check or money order payable to the Washington State Department of Revenue. Mail payment, the return, and a

copy of the filed Federal Estate Tax Return (IRS Form 706 or 706-NA) and all attachments to:

Department of Revenue

Estate Tax Section

PO Box 47488

Olympia, WA 98504-7488

Summary of Tax Due

1. Washington Estate and Transfer Tax (line 13, pg. one, IRS Form 706 or pg. two of

this form if applicable); or for dates of death 1/1/2005 - 5/16/2005 enter 0

0

2. Tax previously paid (explain in attached statement)

3. Tax due with return or amount to be refunded (subtract Line 2 from Line 1)

0

4. Interest

5. Total tax, and interest due (total of Lines 3 and 4)

0

Under penalty of law, I declare that I have examined this return and, to the best of my knowledge and belief, it is true,

correct, and complete.

Signature of Person Required to File

Date

Next Page

REV 85 0037e (a) (05/12/06)

1

1 2

2