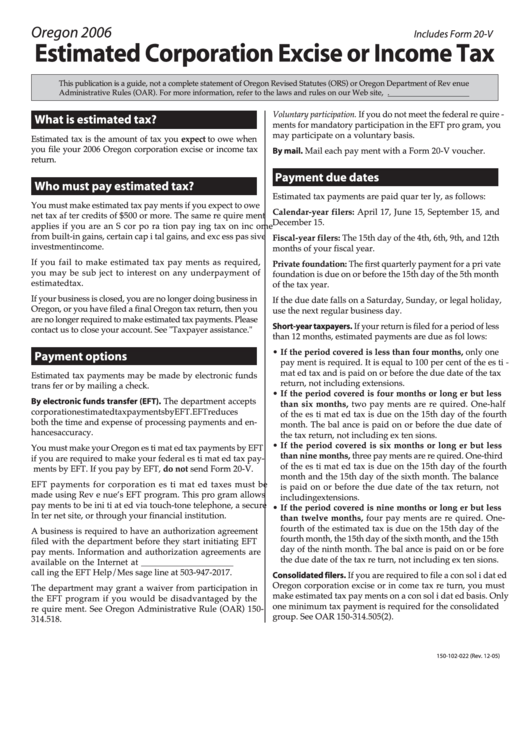

Oregon 2006

Includes Form 20-V

Estimated Corporation Excise or Income Tax

This publication is a guide, not a complete statement of Oregon Revised Statutes (ORS) or Oregon Department of Rev e nue

Administrative Rules (OAR). For more information, refer to the laws and rules on our Web site,

Voluntary participation. If you do not meet the federal re quire -

What is estimated tax?

ments for mandatory participation in the EFT pro gram, you

may participate on a voluntary basis.

Estimated tax is the amount of tax you expect to owe when

you file your 2006 Oregon corporation excise or income tax

By mail. Mail each pay ment with a Form 20-V voucher.

re turn.

Payment due dates

Who must pay estimated tax?

Estimated tax payments are paid quar ter ly, as follows:

You must make estimated tax pay ments if you expect to owe

Calendar-year filers: April 17, June 15, September 15, and

net tax af ter credits of $500 or more. The same re quire ment

December 15.

applies if you are an S cor po ra tion pay ing tax on inc ome

from built-in gains, certain cap i tal gains, and exc ess pas sive

Fiscal-year filers: The 15th day of the 4th, 6th, 9th, and 12th

in vest ment income.

months of your fiscal year.

If you fail to make estimated tax pay ments as required,

Private foundation: The first quarterly payment for a pri vate

you may be sub ject to interest on any underpayment of

foundation is due on or before the 15th day of the 5th month

es ti mat ed tax.

of the tax year.

If your business is closed, you are no longer doing business in

If the due date falls on a Saturday, Sunday, or legal holiday,

Oregon, or you have filed a final Oregon tax return, then you

use the next regular business day.

are no longer required to make estimated tax payments. Please

Short-year taxpayers. If your return is filed for a period of less

contact us to close your account. See "Taxpayer assistance."

than 12 months, estimated payments are due as fol lows:

• If the period covered is less than four months, only one

Payment options

pay ment is required. It is equal to 100 per cent of the es ti -

mat ed tax and is paid on or before the due date of the tax

Estimated tax payments may be made by electronic funds

return, not including extensions.

trans fer or by mailing a check.

• If the period covered is four months or long er but less

By electronic funds transfer (EFT). The department accepts

than six months, two pay ments are re quired. One-half

cor po ra tion es ti mat ed tax payments by EFT. EFT re duc es

of the es ti mat ed tax is due on the 15th day of the fourth

both the time and expense of processing payments and en-

month. The bal ance is paid on or before the due date of

hanc es accuracy.

the tax return, not including ex ten sions.

• If the period covered is six months or long er but less

You must make your Oregon es ti mat ed tax payments by EFT

than nine months, three pay ments are re quired. One-third

if you are required to make your federal es ti mat ed tax pay-

of the es ti mat ed tax is due on the 15th day of the fourth

ments by EFT. If you pay by EFT, do not send Form 20-V.

month and the 15th day of the sixth month. The balance

EFT payments for corporation es ti mat ed taxes must be

is paid on or before the due date of the tax return, not

made using Rev e nue’s EFT program. This pro gram allows

in clud ing ex ten sions.

pay ments to be ini ti at ed via touch-tone telephone, a secure

• If the period covered is nine months or long er but less

In ter net site, or through your financial institution.

than twelve months, four pay ments are re quired. One-

fourth of the estimated tax is due on the 15th day of the

A business is required to have an authorization agreement

fourth month, the 15th day of the sixth month, and the 15th

filed with the department before they start initiating EFT

day of the ninth month. The bal ance is paid on or be fore

pay ments. Information and authorization agreements are

the due date of the tax re turn, not including ex ten sions.

available on the Internet at or by

call ing the EFT Help/Mes sage line at 503-947-2017.

Consolidated filers. If you are required to file a con sol i dat ed

Oregon corporation excise or in come tax re turn, you must

The department may grant a waiver from participation in

make estimated tax pay ments on a con sol i dat ed basis. Only

the EFT program if you would be disadvantaged by the

one minimum tax payment is required for the consolidated

re quire ment. See Oregon Administrative Rule (OAR) 150-

group. See OAR 150-314.505(2).

314.518.

150-102-022 (Rev. 12-05)

1

1 2

2 3

3 4

4