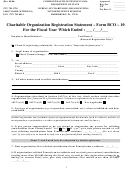

Form Co-1 - Charitable Organization Registration Statement, Form Co-2 - Charitable Organization Financial Information Form, Form Co-3 - Charitable Organization Religious Organization Exemption Form Page 2

ADVERTISEMENT

12. Do you intend to use the services of a professional fund raiser as defined by “An Act to Regulate Solicitation and Collection of Funds for

Charitable Purposes”?

9 Yes

9 No

If “Yes”, answer a, b, and comply with c below.

a. Name and address of professional fund raiser(s): ___________________________________________________________________

_____________________________________________________________________________________________________________

b. Has the professional fund raiser registered and filed a bond with the Office of the Attorney General as required? 9 Yes

9 No

c. Attach copies of all contracts with professional fund raiser(s).

13. Have any of organization’s officers, directors, executive personnel, or have any of the organization’s employees who have access to

funds, ever been charged with or convicted of a misdemeanor involving misapplication or misuse of money of another, or any

felony? 9 Yes

9 No

If “Yes”, give the following information: (IRS 1981 ch.. 23, sec. 5109)

NAME AND ADDRESS OF COURT

NATURE OF OFFENSE

DATE OF CONVICTION(Mo./Yr.)

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

14. State the board, group or individual having final discretion as to the distribution and use of contributions received.

_____________________________________________________________________________________________________________

15. Will you use any of the following methods of solicitation?

9 Unordered Merchandise

9 Distribution or Sale of Seals

9 Telephone Appeals

9 Coin Collection Containers

9 Special Events

9 Ad Books

9 Direct Mail

9 Other --- If other, attach an explanation.

16. List name, mailing address and title of the chief executive or staff officer of the organization. __________________________________

_____________________________________________________________________________________________________________

17. Attach a list of names, mailing addresses, and daytime phone numbers of all officers and directors, or trustees of the organization.

18. Has the United States Internal Revenue Service determined that this organization is tax exempt?

9 Yes

9 No

If “Yes”, attach a copy of the determination letter. Is application pending?

9 Yes

9 No

*All organizations with tax exempt status or an application pending must attach a copy of

Federal Form 1023 “Application for Recognition of Exemption” or an exemption letter.

19. Has organization’s tax exempt status ever been questioned, audited, denied or cancelled at any time by any governmental agency?

9 Yes

9 No

If “Yes”, attach the facts.

20. Organizations which have been in operation for over one (1) year must attach a copy of the form AG990-IL and Federal return,

or AG990IL if no Federal return was filed for each year the organization was in existence, completed in detail. Organizations

which have been in operation less than one (1) year must attach a completed Financial Information Form CO-2, notarized. Please

note charitable organization’s are required to maintain accurate and detailed accounting records.

21. Approximate amount of contributions solicited or income received from persons in this State during the organization’s last annual

accounting period $ _____________________________

22. EVERY REGISTERING ORGANIZATION MUST ATTACH THE FOLLOWING APPLICABLE DOCUMENTS:

Corporation....................................The Articles of Incorporation and/or Certificate of Authority, Amendments and By-Laws

Unincorporated Association...........Constitution and By-Laws

Testamentary Trust.........................Will, Probate number and Decree of Distribution

Inter Vivos Trust.............................Instrument Creating Trust

Note:

The President and the Chief Financial Officer or other authorized officer both are required to sign. This must be two different

individuals. If entity is a Trust, all Trustees must sign.

UNDER PENALTY OF PERJURY, THE UNDERSIGNED DECLARE AND CERTIFY THAT THE INFORMATION CONTAINED

IN THIS STATEMENT AND ALL ATTACHED SHEETS IS TRUE AND CORRECT TO THE BEST OF OUR KNOWLEDGE.

Signature_________________________________________________________________Title___________________________________Date_________________________

Signature_________________________________________________________________Title___________________________________Date_________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5