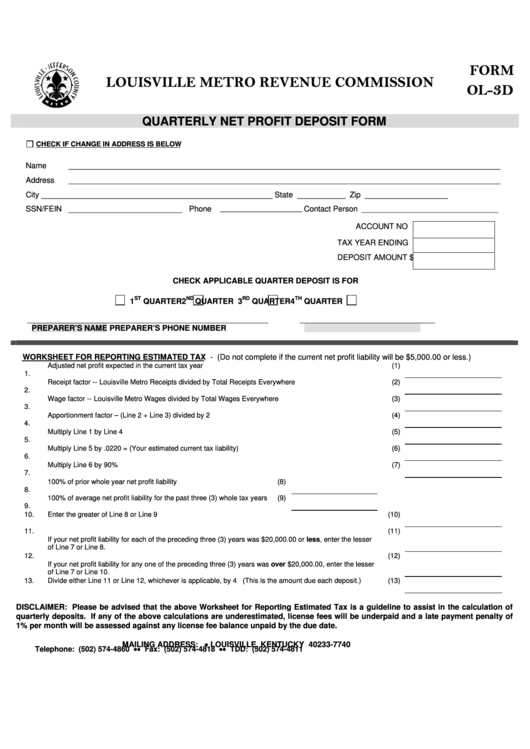

FORM

LOUISVILLE METRO REVENUE COMMISSION

3

OL-

D

QUARTERLY NET PROFIT DEPOSIT FORM

CHECK IF CHANGE IN ADDRESS IS BELOW

Name

___________________________________________________________________________________________________

Address

___________________________________________________________________________________________________

City

_____________________________________________________

State ___________

Zip ___________________

SSN/FEIN __________________________

Phone

_____________________

Contact Person

___________________________________

ACCOUNT NO

TAX YEAR ENDING

DEPOSIT AMOUNT

$

CHECK APPLICABLE QUARTER DEPOSIT IS FOR

ST

ND

RD

TH

1

QUARTER

2

QUARTER

3

QUARTER

4

QUARTER

PREPARER’S NAME

PREPARER’S PHONE NUMBER

WORKSHEET FOR REPORTING ESTIMATED TAX - (Do not complete if the current net profit liability will be $5,000.00 or less.)

1.

Adjusted net profit expected in the current tax year

(1)

2.

Receipt factor -- Louisville Metro Receipts divided by Total Receipts Everywhere

(2)

3.

Wage factor -- Louisville Metro Wages divided by Total Wages Everywhere

(3)

4.

Apportionment factor – (Line 2 + Line 3) divided by 2

(4)

5.

Multiply Line 1 by Line 4

(5)

6.

Multiply Line 5 by .0220 = (Your estimated current tax liability)

(6)

7.

Multiply Line 6 by 90%

(7)

8.

100% of prior whole year net profit liability

(8)

9.

100% of average net profit liability for the past three (3) whole tax years

(9)

10.

Enter the greater of Line 8 or Line 9

(10)

11.

If your net profit liability for each of the preceding three (3) years was $20,000.00 or less, enter the lesser

(11)

of Line 7 or Line 8.

12.

If your net profit liability for any one of the preceding three (3) years was over $20,000.00, enter the lesser

(12)

of Line 7 or Line 10.

13.

Divide either Line 11 or Line 12, whichever is applicable, by 4 (This is the amount due each deposit.)

(13)

DISCLAIMER: Please be advised that the above Worksheet for Reporting Estimated Tax is a guideline to assist in the calculation of

quarterly deposits. If any of the above calculations are underestimated, license fees will be underpaid and a late payment penalty of

1% per month will be assessed against any license fee balance unpaid by the due date.

MAILING ADDRESS: P.O. BOX 37740 • LOUISVILLE, KENTUCKY 40233-7740

Telephone: (502) 574-4860 • • Fax: (502) 574-4818 • • TDD: (502) 574-4811

1

1