Form 941/c1-Me - Combined Filing For Income Tax Withholding And Unemployment Contributions

ADVERTISEMENT

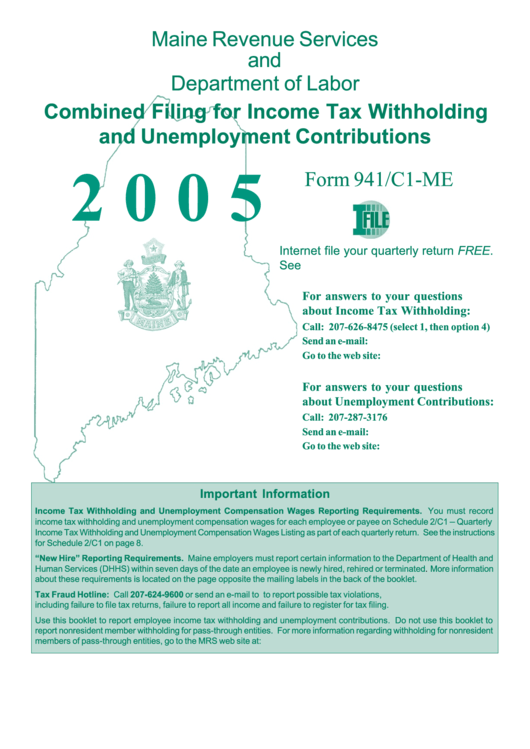

Maine Revenue Services

and

Department of Labor

Combined Filing for Income Tax Withholding

and Unemployment Contributions

2 0 0 5

Form 941/C1-ME

Internet file your quarterly return FREE.

See

For answers to your questions

about Income Tax Withholding:

Call: 207-626-8475 (select 1, then option 4)

Send an e-mail: withholding.tax@maine.gov

Go to the web site:

For answers to your questions

about Unemployment Contributions:

Call: 207-287-3176

Send an e-mail: division.uctax@maine.gov

Go to the web site:

Important Information

Income Tax Withholding and Unemployment Compensation Wages Reporting Requirements. You must record

–

income tax withholding and unemployment compensation wages for each employee or payee on Schedule 2/C1

Quarterly

Income Tax Withholding and Unemployment Compensation Wages Listing as part of each quarterly return. See the instructions

for Schedule 2/C1 on page 8.

“New Hire” Reporting Requirements. Maine employers must report certain information to the Department of Health and

Human Services (DHHS) within seven days of the date an employee is newly hired, rehired or

terminated.

More information

about these requirements is located on the page opposite the mailing labels in the back of the booklet.

Tax Fraud Hotline: Call 207-624-9600 or send an e-mail to compliance.tax@maine.gov to report possible tax violations,

including failure to file tax returns, failure to report all income and failure to register for tax filing.

Use this booklet to report employee income tax withholding and unemployment contributions. Do not use this booklet to

report nonresident member withholding for pass-through entities. For more information regarding withholding for nonresident

members of pass-through entities, go to the MRS web site at:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11