Instructions For Form 941 - Employer'S Quarterly Federal Tax Return - 2005

ADVERTISEMENT

Department of the Treasury

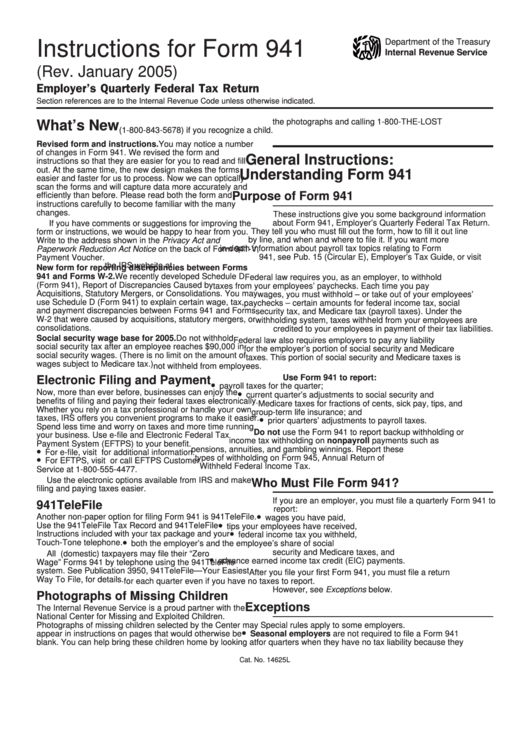

Instructions for Form 941

Internal Revenue Service

(Rev. January 2005)

Employer’s Quarterly Federal Tax Return

Section references are to the Internal Revenue Code unless otherwise indicated.

the photographs and calling 1-800-THE-LOST

What’s New

(1-800-843-5678) if you recognize a child.

Revised form and instructions. You may notice a number

of changes in Form 941. We revised the form and

General Instructions:

instructions so that they are easier for you to read and fill

out. At the same time, the new design makes the forms

Understanding Form 941

easier and faster for us to process. Now we can optically

scan the forms and will capture data more accurately and

Purpose of Form 941

efficiently than before. Please read both the form and

instructions carefully to become familiar with the many

changes.

These instructions give you some background information

about Form 941, Employer’s Quarterly Federal Tax Return.

If you have comments or suggestions for improving the

They tell you who must fill out the form, how to fill it out line

form or instructions, we would be happy to hear from you.

by line, and when and where to file it. If you want more

Write to the address shown in the Privacy Act and

in-depth information about payroll tax topics relating to Form

Paperwork Reduction Act Notice on the back of Form 941-V,

941, see Pub. 15 (Circular E), Employer’s Tax Guide, or visit

Payment Voucher.

the IRS website at

New form for reporting discrepancies between Forms

941 and Forms W-2. We recently developed Schedule D

Federal law requires you, as an employer, to withhold

(Form 941), Report of Discrepancies Caused by

taxes from your employees’ paychecks. Each time you pay

Acquisitions, Statutory Mergers, or Consolidations. You may

wages, you must withhold – or take out of your employees’

use Schedule D (Form 941) to explain certain wage, tax,

paychecks – certain amounts for federal income tax, social

and payment discrepancies between Forms 941 and Forms

security tax, and Medicare tax (payroll taxes). Under the

W-2 that were caused by acquisitions, statutory mergers, or

withholding system, taxes withheld from your employees are

consolidations.

credited to your employees in payment of their tax liabilities.

Social security wage base for 2005. Do not withhold

Federal law also requires employers to pay any liability

social security tax after an employee reaches $90,000 in

for the employer’s portion of social security and Medicare

social security wages. (There is no limit on the amount of

taxes. This portion of social security and Medicare taxes is

wages subject to Medicare tax.)

not withheld from employees.

Use Form 941 to report:

Electronic Filing and Payment

•

payroll taxes for the quarter;

•

Now, more than ever before, businesses can enjoy the

current quarter’s adjustments to social security and

benefits of filing and paying their federal taxes electronically.

Medicare taxes for fractions of cents, sick pay, tips, and

Whether you rely on a tax professional or handle your own

group-term life insurance; and

•

taxes, IRS offers you convenient programs to make it easier.

prior quarters’ adjustments to payroll taxes.

Spend less time and worry on taxes and more time running

Do not use the Form 941 to report backup withholding or

your business. Use e-file and Electronic Federal Tax

income tax withholding on nonpayroll payments such as

Payment System (EFTPS) to your benefit.

•

pensions, annuities, and gambling winnings. Report these

For e-file, visit for additional information.

•

types of withholding on Form 945, Annual Return of

For EFTPS, visit or call EFTPS Customer

Withheld Federal Income Tax.

Service at 1-800-555-4477.

Use the electronic options available from IRS and make

Who Must File Form 941?

filing and paying taxes easier.

If you are an employer, you must file a quarterly Form 941 to

941TeleFile

report:

•

Another non-paper option for filing Form 941 is 941TeleFile.

wages you have paid,

•

Use the 941TeleFile Tax Record and 941TeleFile

tips your employees have received,

•

Instructions included with your tax package and your

federal income tax you withheld,

•

Touch-Tone telephone.

both the employer’s and the employee’s share of social

security and Medicare taxes, and

All U.S.-based (domestic) taxpayers may file their “Zero

•

advance earned income tax credit (EIC) payments.

Wage” Forms 941 by telephone using the 941TeleFile

system. See Publication 3950, 941TeleFile — Your Easiest

After you file your first Form 941, you must file a return

Way To File, for details.

for each quarter even if you have no taxes to report.

However, see Exceptions below.

Photographs of Missing Children

Exceptions

The Internal Revenue Service is a proud partner with the

National Center for Missing and Exploited Children.

Photographs of missing children selected by the Center may

Special rules apply to some employers.

•

appear in instructions on pages that would otherwise be

Seasonal employers are not required to file a Form 941

blank. You can help bring these children home by looking at

for quarters when they have no tax liability because they

Cat. No. 14625L

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9