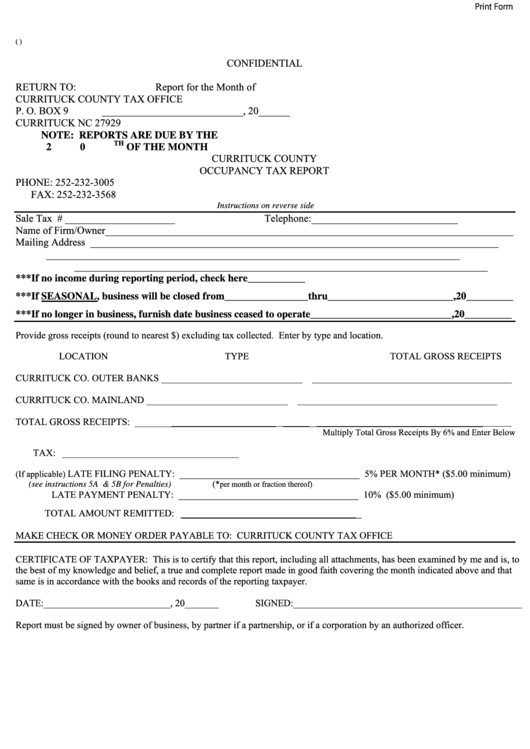

Print Form

(OTP.rev.02_2011)

CONFIDENTIAL

RETURN TO:

Report for the Month of

CURRITUCK COUNTY TAX OFFICE

P. O. BOX 9

___________________________, 20______

CURRITUCK NC 27929

NOTE: REPORTS ARE DUE BY THE

TH

20

OF THE MONTH

CURRITUCK COUNTY

OCCUPANCY TAX REPORT

PHONE: 252-232-3005

FAX: 252-232-3568

Instructions on reverse side

Sale Tax I.D. # _____________________

Telephone:____________________________

Name of Firm/Owner______________________________________________________________________________

Mailing Address

______________________________________________________________________________

_______________________________________________________________________________

_______________________________________________________________________________

***If no income during reporting period, check here___________

***If SEASONAL, business will be closed from________________thru________________________,20_________

***If no longer in business, furnish date business ceased to operate___________________________,20_________

Provide gross receipts (round to nearest $) excluding tax collected. Enter by type and location.

LOCATION

TYPE

TOTAL GROSS RECEIPTS

CURRITUCK CO. OUTER BANKS

_____________________________ _________________________________________

CURRITUCK CO. MAINLAND

_____________________________ _________________________________________

TOTAL GROSS RECEIPTS:

_____________________________ _________________________________________

Multiply Total Gross Receipts By 6% and Enter Below

TAX:

________________________________________

LATE FILING PENALTY: _____________________________________ 5% PER MONTH* ($5.00 minimum)

(If applicable)

(*

per month or fraction thereof)

(see instructions 5A & 5B for Penalties)

LATE PAYMENT PENALTY: _____________________________________ 10% ($5.00 minimum)

TOTAL AMOUNT REMITTED: _____________________________________

MAKE CHECK OR MONEY ORDER PAYABLE TO: CURRITUCK COUNTY TAX OFFICE

CERTIFICATE OF TAXPAYER: This is to certify that this report, including all attachments, has been examined by me and is, to

the best of my knowledge and belief, a true and complete report made in good faith covering the month indicated above and that

same is in accordance with the books and records of the reporting taxpayer.

DATE:__________________________, 20_______

SIGNED:_______________________________________________

Report must be signed by owner of business, by partner if a partnership, or if a corporation by an authorized officer.

1

1 2

2