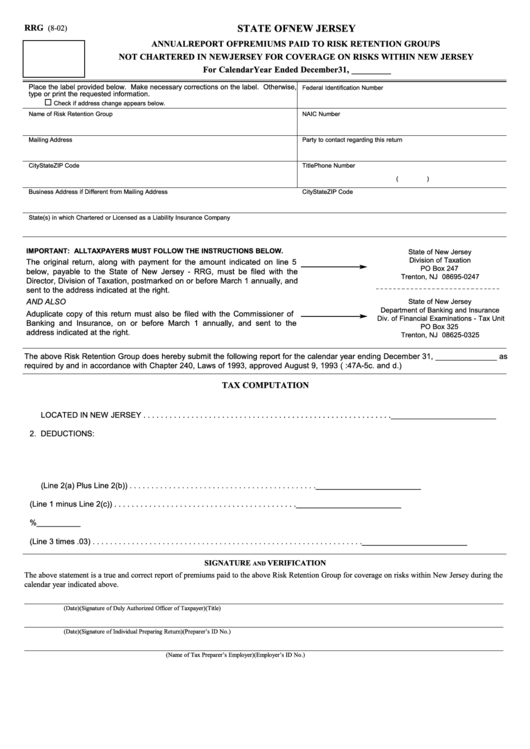

STATE OF NEW JERSEY

RRG

(8-02)

ANNUAL REPORT OF PREMIUMS PAID TO RISK RETENTION GROUPS

NOT CHARTERED IN NEW JERSEY FOR COVERAGE ON RISKS WITHIN NEW JERSEY

For Calendar Year Ended December 31, _________

Place the label provided below. Make necessary corrections on the label. Otherwise,

Federal Identification Number

type or print the requested information.

Check if address change appears below.

Name of Risk Retention Group

NAIC Number

Mailing Address

Party to contact regarding this return

City

State

ZIP Code

Title

Phone Number

(

)

Business Address if Different from Mailing Address

City

State

ZIP Code

State(s) in which Chartered or Licensed as a Liability Insurance Company

IMPORTANT: ALL TAXPAYERS MUST FOLLOW THE INSTRUCTIONS BELOW.

State of New Jersey

Division of Taxation

The original return, along with payment for the amount indicated on line 5

PO Box 247

below, payable to the State of New Jersey - RRG, must be filed with the

Trenton, NJ 08695-0247

Director, Division of Taxation, postmarked on or before March 1 annually, and

sent to the address indicated at the right.

AND ALSO

State of New Jersey

Department of Banking and Insurance

A duplicate copy of this return must also be filed with the Commissioner of

Div. of Financial Examinations - Tax Unit

Banking and Insurance, on or before March 1 annually, and sent to the

PO Box 325

address indicated at the right.

Trenton, NJ 08625-0325

The above Risk Retention Group does hereby submit the following report for the calendar year ending December 31, ______________ as

required by and in accordance with Chapter 240, Laws of 1993, approved August 9, 1993 (N.J.S.A. 17:47A-5c. and d.)

TAX COMPUTATION

1. TOTAL PREMIUMS RECEIVED FOR COVERAGE ON RISKS

LOCATED IN NEW JERSEY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

2. DEDUCTIONS:

a.

Premiums Returned . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

b.

Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

c.

Total Deductions (Line 2(a) Plus Line 2(b)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

3. TAXABLE PREMIUMS (Line 1 minus Line 2(c)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

4. TAX RATE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ___________3%__________

5. TAX (Line 3 times .03) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

SIGNATURE

VERIFICATION

AND

The above statement is a true and correct report of premiums paid to the above Risk Retention Group for coverage on risks within New Jersey during the

calendar year indicated above.

___________________________________________________________________________________________________________________________

(Date)

(Signature of Duly Authorized Officer of Taxpayer)

(Title)

___________________________________________________________________________________________________________________________

(Date)

(Signature of Individual Preparing Return)

(Preparer’s ID No.)

___________________________________________________________________________________________________________________________

(Name of Tax Preparer’s Employer)

(Employer’s ID No.)

1

1