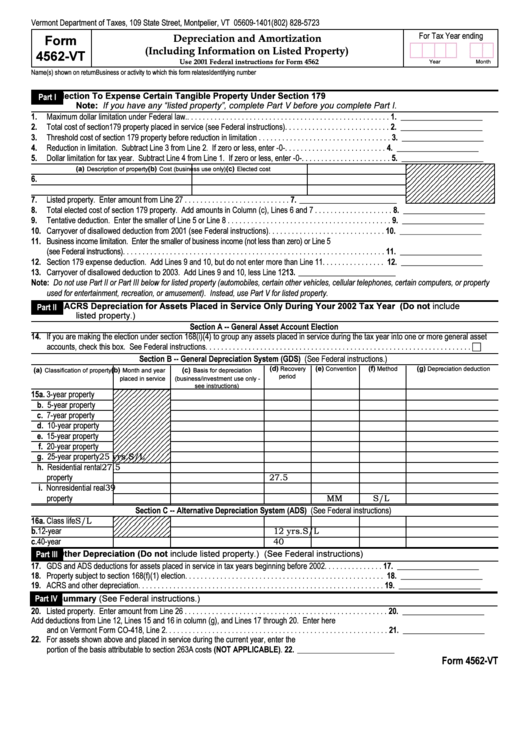

Form 4562-Vt - Depreciation And Amortization (Including Information On Listed Property)

ADVERTISEMENT

Depreciation and Amortization

Form

(Including Information on Listed Property)

4562-VT

Use 2001 Federal instructions for Form 4562

Year

Month

Name(s) shown on return

Business or activity to which this form relates

Identifying number

Election To Expense Certain Tangible Property Under Section 179

Note: If you have any “listed property”, complete Part V before you complete Part I.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

(a)

(b)

(c)

Description of property

Cost (business use only)

Elected cost

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

Do not use Part II or Part III below for listed property (automobiles, certain other vehicles, cellular telephones, certain computers, or property

used for entertainment, recreation, or amusement). Instead, use Part V for listed property.

MACRS Depreciation for Assets Placed in Service Only During Your 2002 Tax Year (Do not include

listed property.)

c

(d)

(e)

(f)

(g)

Recovery

Convention

Method

Depreciation deduction

(a)

(b)

(c)

Classification of property

Month and year

Basis for depreciation

period

placed in service

(business/investment use only -

see instructions)

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

25 yrs.

S/L

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

27.5 yrs.

MM

S/L

27.5 yrs.

MM

S/L

39 yrs.

MM

S/L

MM

S/L

1 2 3 4 5 6 7 8 9 0 1 2 3 4

S/L

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

12 yrs.

S/L

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

40 yrs.

MM

S/L

Other Depreciation (Do not include listed property.) (See Federal instructions)

Summary (See Federal instructions.)

Form 4562-VT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2