Personal Income Tax Appeal Form - California State Board Of Equalization

ADVERTISEMENT

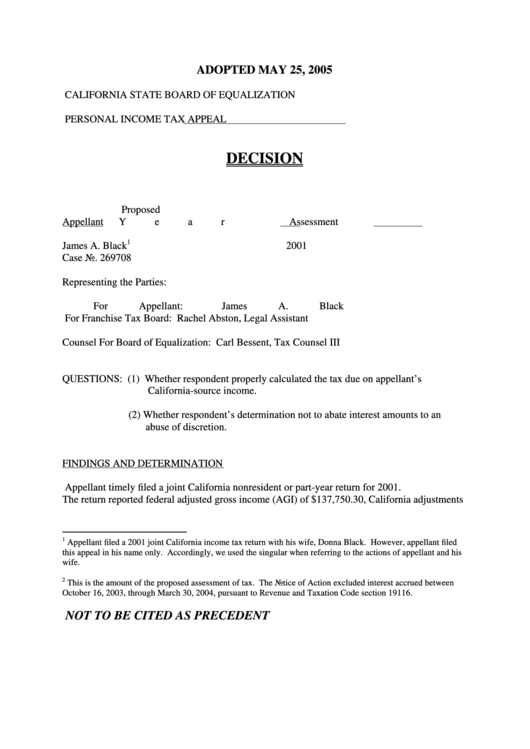

ADOPTED MAY 25, 2005

CALIFORNIA STATE BOARD OF EQUALIZATION

PERSONAL INCOME TAX APPEAL

DECISION

Proposed

Appellant

Year

Assessment

1

2

James A. Black

2001

$736

Case No. 269708

Representing the Parties:

For Appellant:

James A. Black

For Franchise Tax Board:

Rachel Abston, Legal Assistant

Counsel For Board of Equalization:

Carl Bessent, Tax Counsel III

QUESTIONS: (1) Whether respondent properly calculated the tax due on appellant’s

California-source income.

(2) Whether respondent’s determination not to abate interest amounts to an

abuse of discretion.

FINDINGS AND DETERMINATION

Appellant timely filed a joint California nonresident or part-year return for 2001.

The return reported federal adjusted gross income (AGI) of $137,750.30, California adjustments

1

Appellant filed a 2001 joint California income tax return with his wife, Donna Black. However, appellant filed

this appeal in his name only. Accordingly, we used the singular when referring to the actions of appellant and his

wife.

2

This is the amount of the proposed assessment of tax. The Notice of Action excluded interest accrued between

October 16, 2003, through March 30, 2004, pursuant to Revenue and Taxation Code section 19116.

NOT TO BE CITED AS PRECEDENT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6