Credit For Energy Providers To Aluminum Smelters Form - Washington State Department Of Revenue

ADVERTISEMENT

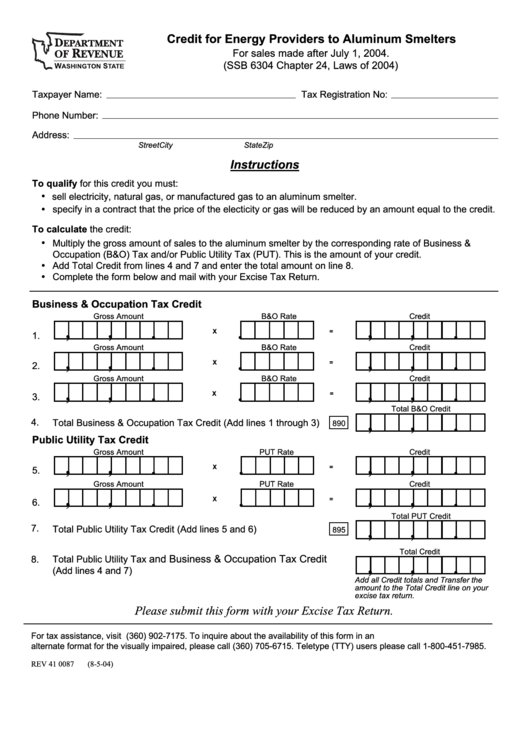

Credit for Energy Providers to Aluminum Smelters

For sales made after July 1, 2004.

(SSB 6304 Chapter 24, Laws of 2004)

Taxpayer Name:

Tax Registration No:

Phone Number:

Address:

Street

City

State

Zip

Instructions

To qualify for this credit you must:

sell electricity, natural gas, or manufactured gas to an aluminum smelter.

h

specify in a contract that the price of the electicity or gas will be reduced by an amount equal to the credit.

h

To calculate the credit:

Multiply the gross amount of sales to the aluminum smelter by the corresponding rate of Business &

h

Occupation (B&O) Tax and/or Public Utility Tax (PUT). This is the amount of your credit.

Add Total Credit from lines 4 and 7 and enter the total amount on line 8.

h

Complete the form below and mail with your Excise Tax Return.

h

Business & Occupation Tax Credit

Gross Amount

B&O Rate

Credit

,

,

,

,

.

.

.

X

=

1.

Gross Amount

B&O Rate

Credit

,

,

,

,

.

.

.

X

=

2.

Gross Amount

B&O Rate

Credit

,

,

,

,

.

.

.

X

=

3.

Total B&O Credit

4.

Total Business & Occupation Tax Credit (Add lines 1 through 3)

,

,

890

.

Public Utility Tax Credit

Gross Amount

PUT Rate

Credit

,

,

,

,

.

.

.

X

=

5.

Gross Amount

PUT Rate

Credit

,

,

,

,

.

.

.

X

=

6.

Total PUT Credit

7.

Total Public Utility Tax Credit (Add lines 5 and 6)

895

,

,

.

Total Credit

and Business & Occupation Tax Credit

8.

Total Public Utility Tax

,

,

.

(Add lines 4 and 7)

Add all Credit totals and Transfer the

amount to the Total Credit line on your

excise tax return.

Please submit this form with your Excise Tax Return.

For tax assistance, visit or call (360) 902-7175. To inquire about the availability of this form in an

alternate format for the visually impaired, please call (360) 705-6715. Teletype (TTY) users please call 1-800-451-7985.

REV 41 0087

(8-5-04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1