Form Eft-100c - Authorization Agreement

ADVERTISEMENT

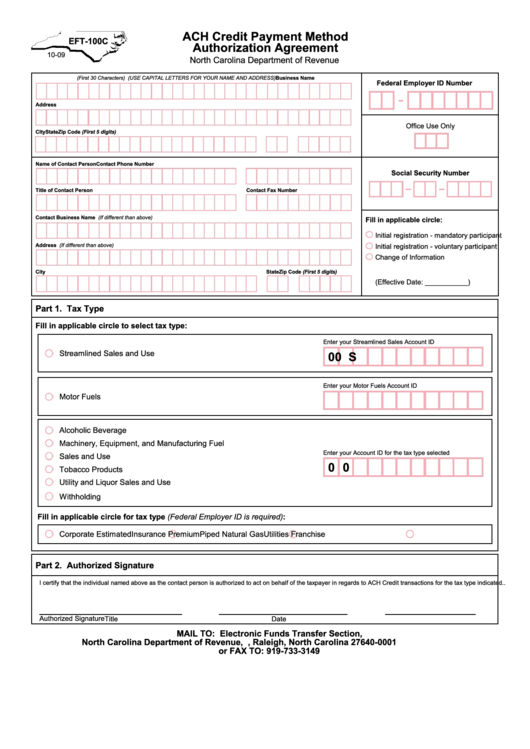

ACH Credit Payment Method

EFT-100C

Authorization Agreement

10-09

North Carolina Department of Revenue

Business Name

(First 30 Characters) (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Federal Employer ID Number

Address

Office Use Only

City

State

Zip Code (First 5 digits)

Name of Contact Person

Contact Phone Number

Social Security Number

Contact Fax Number

Title of Contact Person

Contact Business Name (If different than above)

Fill in applicable circle:

Initial registration - mandatory participant

Address (If different than above)

Initial registration - voluntary participant

Change of Information

City

State

Zip Code (First 5 digits)

(Effective Date: ___________ )

Part 1. Tax Type

Fill in applicable circle to select tax type:

Enter your Streamlined Sales Account ID

Streamlined Sales and Use

0 0 S

Enter your Motor Fuels Account ID

Motor Fuels

Alcoholic Beverage

Machinery, Equipment, and Manufacturing Fuel

Enter your Account ID for the tax type selected

Sales and Use

0 0

Tobacco Products

Utility and Liquor Sales and Use

Withholding

Fill in applicable circle for tax type (Federal Employer ID is required):

Corporate Estimated

Insurance Premium

Piped Natural Gas

Utilities Franchise

Part 2. Authorized Signature

I certify that the individual named above as the contact person is authorized to act on behalf of the taxpayer in regards to ACH Credit transactions for the tax type indicated..

Authorized Signature

Title

Date

MAIL TO: Electronic Funds Transfer Section,

North Carolina Department of Revenue, P.O. Box 25000, Raleigh, North Carolina 27640-0001

or FAX TO: 919-733-3149

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1