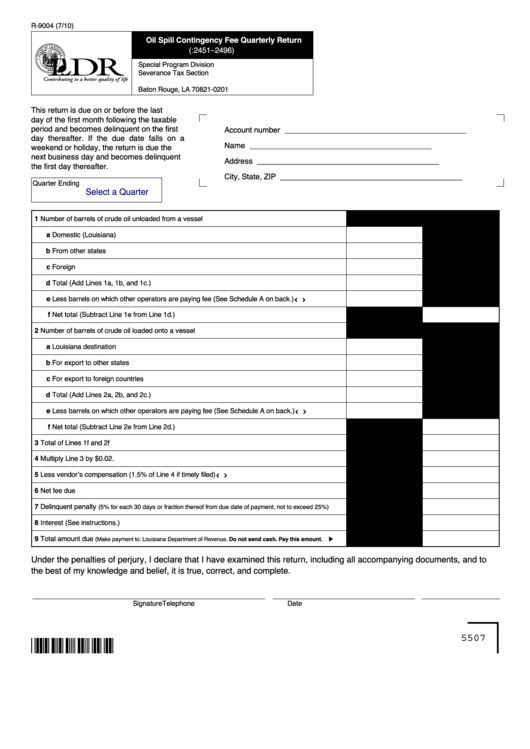

R-9004 (7/10)

Oil Spill Contingency Fee Quarterly Return

(R.S. 30:2451–2496)

Special Program Division

Severance Tax Section

P.O. Box 201

Baton Rouge, LA 70821-0201

This return is due on or before the last

day of the first month following the taxable

period and becomes delinquent on the first

Account number

__________________________________________

day thereafter. If the due date falls on a

Name

__________________________________________

weekend or holiday, the return is due the

next business day and becomes delinquent

Address

__________________________________________

the first day thereafter.

City, State, ZIP

__________________________________________

Quarter Ending

Select a Quarter

1 Number of barrels of crude oil unloaded from a vessel

a Domestic (Louisiana)

b From other states

c Foreign

d Total (Add Lines 1a, 1b, and 1c.)

‹

›

e Less barrels on which other operators are paying fee (See Schedule A on back.)

f Net total (Subtract Line 1e from Line 1d.)

2 Number of barrels of crude oil loaded onto a vessel

a Louisiana destination

b For export to other states

c For export to foreign countries

d Total (Add Lines 2a, 2b, and 2c.)

‹

›

e Less barrels on which other operators are paying fee (See Schedule A on back.)

f Net total (Subtract Line 2e from Line 2d.)

3 Total of Lines 1f and 2f

4 Multiply Line 3 by $0.02.

‹

›

5 Less vendor’s compensation (1.5% of Line 4 if timely filed)

6 Net fee due

7 Delinquent penalty

(5% for each 30 days or fraction thereof from due date of payment, not to exceed 25%)

8 Interest (See instructions.)

9 Total amount due

(Make payment to: Louisiana Department of Revenue. Do not send cash. Pay this amount.

u

Under the penalties of perjury, I declare that I have examined this return, including all accompanying documents, and to

the best of my knowledge and belief, it is true, correct, and complete.

Signature

Telephone

Date

5507

1

1 2

2