Form Ftb 5847i - Procedure For Appealing A Denial Or Partial Denial Of Arequest For Abatement Of Interest - California State Board Of Equalization

ADVERTISEMENT

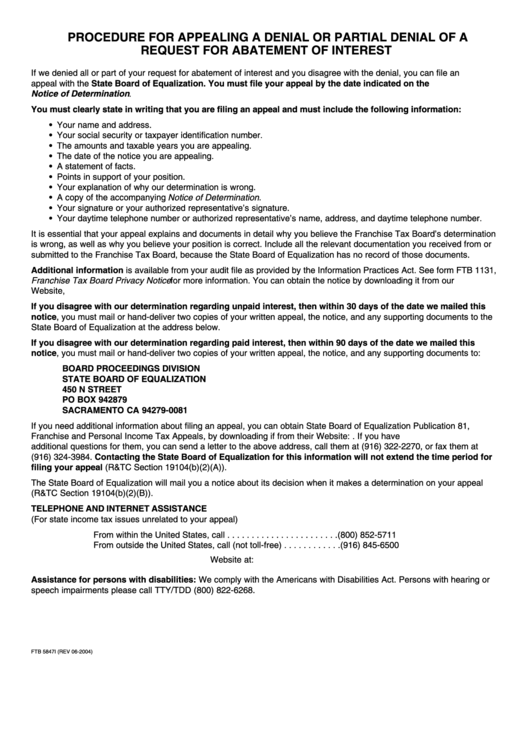

PROCEDURE FOR APPEALING A DENIAL OR PARTIAL DENIAL OF A

REQUEST FOR ABATEMENT OF INTEREST

If we denied all or part of your request for abatement of interest and you disagree with the denial, you can file an

appeal with the State Board of Equalization. You must file your appeal by the date indicated on the

Notice of Determination .

You must clearly state in writing that you are filing an appeal and must include the following information:

• Your name and address.

• Your social security or taxpayer identification number.

• The amounts and taxable years you are appealing.

• The date of the notice you are appealing.

• A statement of facts.

• Points in support of your position.

• Your explanation of why our determination is wrong.

• A copy of the accompanying Notice of Determination .

• Your signature or your authorized representative’s signature.

• Your daytime telephone number or authorized representative’s name, address, and daytime telephone number.

It is essential that your appeal explains and documents in detail why you believe the Franchise Tax Board’s determination

is wrong, as well as why you believe your position is correct. Include all the relevant documentation you received from or

submitted to the Franchise Tax Board, because the State Board of Equalization has no record of those documents.

Additional information is available from your audit file as provided by the Information Practices Act. See form FTB 1131,

Franchise Tax Board Privacy Notice for more information. You can obtain the notice by downloading it from our

Website,

If you disagree with our determination regarding unpaid interest, then within 30 days of the date we mailed this

notice, you must mail or hand-deliver two copies of your written appeal, the notice, and any supporting documents to the

State Board of Equalization at the address below.

If you disagree with our determination regarding paid interest, then within 90 days of the date we mailed this

notice, you must mail or hand-deliver two copies of your written appeal, the notice, and any supporting documents to:

BOARD PROCEEDINGS DIVISION

STATE BOARD OF EQUALIZATION

450 N STREET

PO BOX 942879

SACRAMENTO CA 94279-0081

If you need additional information about filing an appeal, you can obtain State Board of Equalization Publication 81,

Franchise and Personal Income Tax Appeals, by downloading if from their Website: If you have

additional questions for them, you can send a letter to the above address, call them at (916) 322-2270, or fax them at

(916) 324-3984. Contacting the State Board of Equalization for this information will not extend the time period for

filing your appeal (R&TC Section 19104(b)(2)(A)).

The State Board of Equalization will mail you a notice about its decision when it makes a determination on your appeal

(R&TC Section 19104(b)(2)(B)).

TELEPHONE AND INTERNET ASSISTANCE

(For state income tax issues unrelated to your appeal)

From within the United States, call . . . . . . . . . . . . . . . . . . . . . . . (800) 852-5711

From outside the United States, call (not toll-free) . . . . . . . . . . . . (916) 845-6500

Website at:

Assistance for persons with disabilities: We comply with the Americans with Disabilities Act. Persons with hearing or

speech impairments please call TTY/TDD (800) 822-6268.

FTB 5847I (REV 06-2004)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1