Taxes Of The City Of Cherry Hills Village Sheet

ADVERTISEMENT

Cherry Hills Village - Taxes

Taxes

1. Sales Tax

The City of Cherry Hills Village has a sales tax of 3.5% for the selling of tangible personal property at retail upon every

vendor having a place of business and who sells such property within the City. Examples of possible businesses within the

City would be the pro shops at either of the country clubs, craft shows, book fairs or other merchandise sales at any of the

churches. City sales tax is collected only on tangible personal property; services are not taxed. The City does not have or

collect a sales tax on deliveries into the community. Please view Chapter 4 of our

Municipal Code

for more details.

The City does not issue sales tax licenses. To remit sales tax for sales of personal tangible property within the City,

download the Sales Tax Return Form found below and remit with sales tax to 2450 E. Quincy Ave., Cherry Hills Village, CO

80113.

Sales Tax Return Form.pdf

Sales Tax Return Form.xls

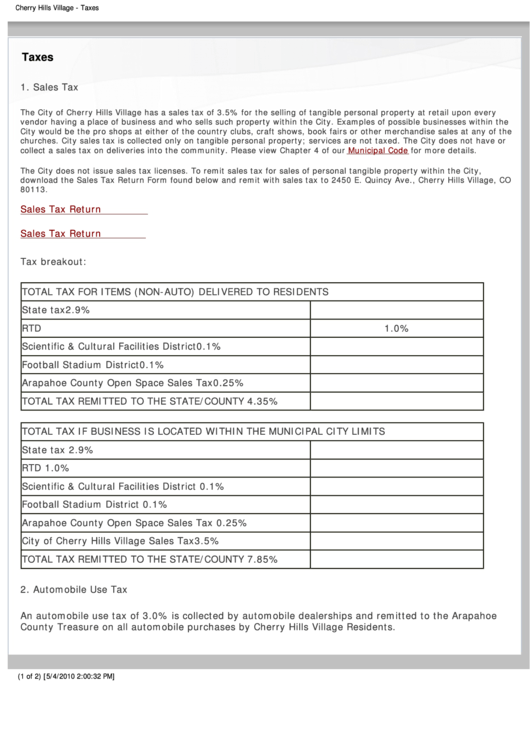

Tax breakout:

TOTAL TAX FOR ITEMS (NON-AUTO) DELIVERED TO RESIDENTS

State tax

2.9%

RTD

1.0%

Scientific & Cultural Facilities District

0.1%

Football Stadium District

0.1%

Arapahoe County Open Space Sales Tax

0.25%

TOTAL TAX REMITTED TO THE STATE/COUNTY

4.35%

TOTAL TAX IF BUSINESS IS LOCATED WITHIN THE MUNICIPAL CITY LIMITS

State tax

2.9%

RTD

1.0%

Scientific & Cultural Facilities District

0.1%

Football Stadium District

0.1%

Arapahoe County Open Space Sales Tax

0.25%

City of Cherry Hills Village Sales Tax

3.5%

TOTAL TAX REMITTED TO THE STATE/COUNTY

7.85%

2. Automobile Use Tax

An automobile use tax of 3.0% is collected by automobile dealerships and remitted to the Arapahoe

County Treasure on all automobile purchases by Cherry Hills Village Residents.

(1 of 2) [5/4/2010 2:00:32 PM]

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2