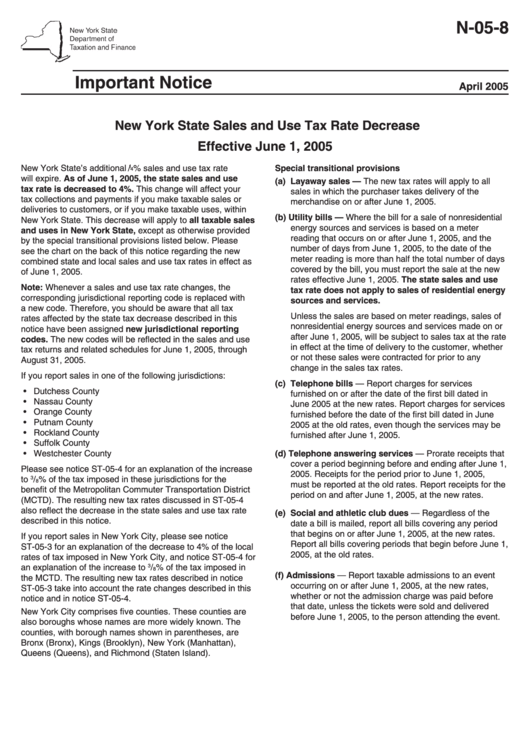

Form N-05-8 - New York State Sales And Use Tax Rate Decrease - New York State Department Of Taxtation And Finance

ADVERTISEMENT

N-05-8

Important Notice

April 2005

New York State Sales and Use Tax Rate Decrease

Effective June 1, 2005

New York State’s additional

/

% sales and use tax rate

Special transitional provisions

1

4

will expire. As of June 1, 2005, the state sales and use

(a) Layaway sales — The new tax rates will apply to all

tax rate is decreased to 4%. This change will affect your

sales in which the purchaser takes delivery of the

tax collections and payments if you make taxable sales or

merchandise on or after June 1, 2005.

deliveries to customers, or if you make taxable uses, within

(b) Utility bills — Where the bill for a sale of nonresidential

New York State. This decrease will apply to all taxable sales

energy sources and services is based on a meter

and uses in New York State, except as otherwise provided

reading that occurs on or after June 1, 2005, and the

by the special transitional provisions listed below. Please

number of days from June 1, 2005, to the date of the

see the chart on the back of this notice regarding the new

meter reading is more than half the total number of days

combined state and local sales and use tax rates in effect as

covered by the bill, you must report the sale at the new

of June 1, 2005.

rates effective June 1, 2005. The state sales and use

Note: Whenever a sales and use tax rate changes, the

tax rate does not apply to sales of residential energy

corresponding jurisdictional reporting code is replaced with

sources and services.

a new code. Therefore, you should be aware that all tax

Unless the sales are based on meter readings, sales of

rates affected by the state tax decrease described in this

nonresidential energy sources and services made on or

notice have been assigned new jurisdictional reporting

after June 1, 2005, will be subject to sales tax at the rate

codes. The new codes will be reflected in the sales and use

in effect at the time of delivery to the customer, whether

tax returns and related schedules for June 1, 2005, through

or not these sales were contracted for prior to any

August 31, 2005.

change in the sales tax rates.

If you report sales in one of the following jurisdictions:

(c) Telephone bills — Report charges for services

• Dutchess County

furnished on or after the date of the first bill dated in

• Nassau County

June 2005 at the new rates. Report charges for services

• Orange County

furnished before the date of the first bill dated in June

• Putnam County

2005 at the old rates, even though the services may be

• Rockland County

furnished after June 1, 2005.

• Suffolk County

• Westchester County

(d) Telephone answering services — Prorate receipts that

cover a period beginning before and ending after June 1,

Please see notice ST-05-4 for an explanation of the increase

2005. Receipts for the period prior to June 1, 2005,

to

/

% of the tax imposed in these jurisdictions for the

3

8

must be reported at the old rates. Report receipts for the

benefit of the Metropolitan Commuter Transportation District

period on and after June 1, 2005, at the new rates.

(MCTD). The resulting new tax rates discussed in ST-05-4

also reflect the decrease in the state sales and use tax rate

(e) Social and athletic club dues — Regardless of the

described in this notice.

date a bill is mailed, report all bills covering any period

that begins on or after June 1, 2005, at the new rates.

If you report sales in New York City, please see notice

Report all bills covering periods that begin before June 1,

ST-05-3 for an explanation of the decrease to 4% of the local

2005, at the old rates.

rates of tax imposed in New York City, and notice ST-05-4 for

an explanation of the increase to

/

% of the tax imposed in

3

8

(f) Admissions — Report taxable admissions to an event

the MCTD. The resulting new tax rates described in notice

occurring on or after June 1, 2005, at the new rates,

ST-05-3 take into account the rate changes described in this

whether or not the admission charge was paid before

notice and in notice ST-05-4.

that date, unless the tickets were sold and delivered

New York City comprises five counties. These counties are

before June 1, 2005, to the person attending the event.

also boroughs whose names are more widely known. The

counties, with borough names shown in parentheses, are

Bronx (Bronx), Kings (Brooklyn), New York (Manhattan),

Queens (Queens), and Richmond (Staten Island).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2