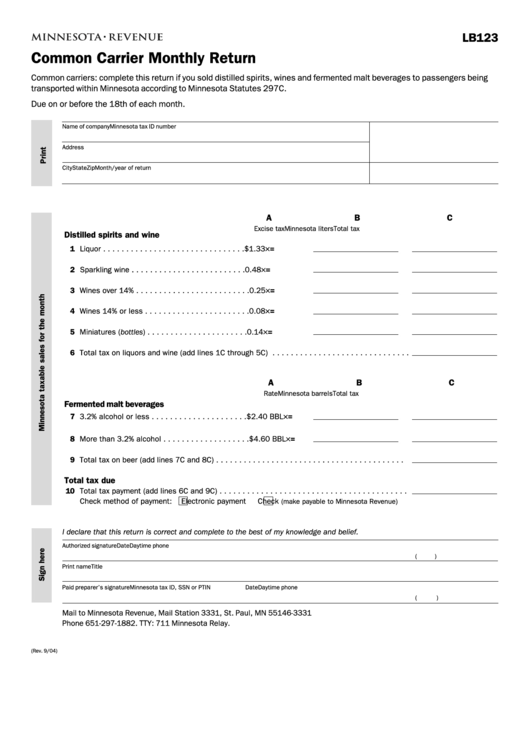

LB123

Common Carrier Monthly Return

Common carriers: complete this return if you sold distilled spirits, wines and fermented malt beverages to passengers being

transported within Minnesota according to Minnesota Statutes 297C.

Due on or before the 18th of each month.

Name of company

Minnesota tax ID number

Address

City

State

Zip

Month/year of return

A

B

C

Excise tax

Minnesota liters

Total tax

Distilled spirits and wine

1 Liquor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1.33

×

=

2 Sparkling wine . . . . . . . . . . . . . . . . . . . . . . . . .

0.48

×

=

3 Wines over 14% . . . . . . . . . . . . . . . . . . . . . . . . .

0.25

×

=

4 Wines 14% or less . . . . . . . . . . . . . . . . . . . . . . .

0.08

×

=

5 Miniatures (bottles) . . . . . . . . . . . . . . . . . . . . . .

0.14

×

=

6 Total tax on liquors and wine (add lines 1C through 5C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

A

B

C

Rate

Minnesota barrels

Total tax

Fermented malt beverages

7 3.2% alcohol or less . . . . . . . . . . . . . . . . . . . . . $2.40 BBL ×

=

8 More than 3.2% alcohol . . . . . . . . . . . . . . . . . . . $4.60 BBL ×

=

9 Total tax on beer (add lines 7C and 8C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total tax due

10 Total tax payment (add lines 6C and 9C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Check method of payment:

Electronic payment

Check

(make payable to Minnesota Revenue)

I declare that this return is correct and complete to the best of my knowledge and belief.

Authorized signature

Date

Daytime phone

(

)

Print name

Title

Paid preparer’s signature

Minnesota tax ID, SSN or PTIN

Date

Daytime phone

(

)

Mail to Minnesota Revenue, Mail Station 3331, St. Paul, MN 55146-3331

Phone 651-297-1882. TTY: 711 Minnesota Relay.

(Rev. 9/04)

1

1 2

2