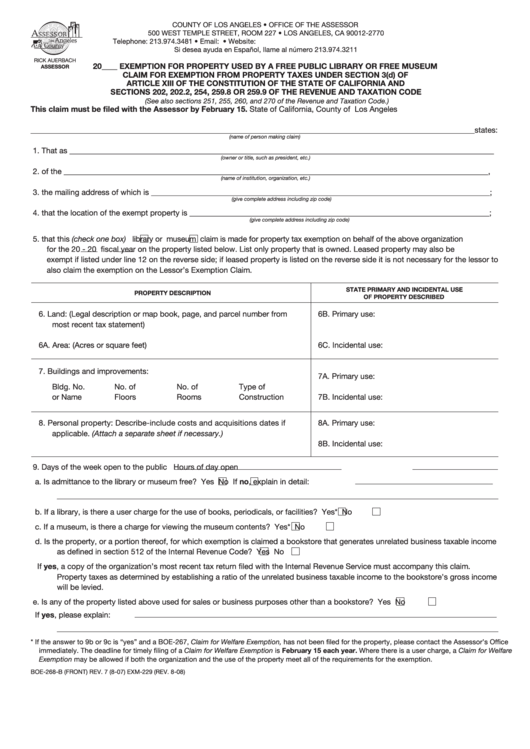

COUNTY OF LOS ANGELES • OFFICE OF THE ASSESSOR

500 WEST TEMPLE STREET, ROOM 227 • LOS ANGELES, CA 90012-2770

Telephone: 213.974.3481 • Email: exempt@assessor.lacounty.gov • Website: assessor.lacounty.gov

Si desea ayuda en Español, llame al número 213.974.3211

RICK AUERBACH

20____ EXEMPTION FOR PROPERTY USED BY A FREE PUBLIC LIBRARY OR FREE MUSEUM

ASSESSOR

CLAIM FOR EXEMPTION FROM PROPERTY TAXES UNDER SECTION 3(d) OF

ARTICLE XIII OF THE CONSTITUTION OF THE STATE OF CALIFORNIA AND

SECTIONS 202, 202.2, 254, 259.8 OR 259.9 OF THE REVENUE AND TAXATION CODE

(See also sections 251, 255, 260, and 270 of the Revenue and Taxation Code.)

This claim must be filed with the Assessor by February 15.

State of California, County of Los Angeles

ssssssssss

ss

__________________________________________________________________________________________________________________states:

(name of person making claim)

1. That as _____________________________________________________________________________________________________________

(owner or title, such as president, etc.)

2. of the _____________________________________________________________________________________________________________ ,

(name of institution, organization, etc.)

3. the mailing address of which is _______________________________________________________________________________________ ;

(give complete address including zip code)

4. that the location of the exempt property is _____________________________________________________________________________ ;

(give complete address including zip code)

5. that this (check one box)

library or

museum claim is made for property tax exemption on behalf of the above organization

for the 20

- 20

fiscal year on the property listed below. List only property that is owned. Leased property may also be

exempt if listed under line 12 on the reverse side; if leased property is listed on the reverse side it is not necessary for the lessor to

also claim the exemption on the Lessor’s Exemption Claim.

STATE PRIMARY AND INCIDENTAL USE

PROPERTY DESCRIPTION

OF PROPERTY DESCRIBED

6. Land: (Legal description or map book, page, and parcel number from

6B. Primary use:

most recent tax statement)

6A. Area: (Acres or square feet)

6C. Incidental use:

7. Buildings and improvements:

7A. Primary use:

Bldg. No.

No. of

No. of

Type of

or Name

Floors

Rooms

Construction

7B. Incidental use:

8. Personal property: Describe-include costs and acquisitions dates if

8A. Primary use:

applicable. (Attach a separate sheet if necessary.)

8B. Incidental use:

9. Days of the week open to the public

Hours of day open

No If no, explain in detail:

a. Is admittance to the library or museum free?

Yes

b. If a library, is there a user charge for the use of books, periodicals, or facilities?

Yes*

No

c. If a museum, is there a charge for viewing the museum contents?

Yes*

No

d. Is the property, or a portion thereof, for which exemption is claimed a bookstore that generates unrelated business taxable income

as defined in section 512 of the Internal Revenue Code?

Yes

No

If yes, a copy of the organization’s most recent tax return filed with the Internal Revenue Service must accompany this claim.

Property taxes as determined by establishing a ratio of the unrelated business taxable income to the bookstore’s gross income

will be levied.

e. Is any of the property listed above used for sales or business purposes other than a bookstore?

Yes

No

If yes, please explain:

* If the answer to 9b or 9c is “yes” and a BOE-267, Claim for Welfare Exemption, has not been filed for the property, please contact the Assessor’s Office

immediately. The deadline for timely filing of a Claim for Welfare Exemption is February 15 each year. Where there is a user charge, a Claim for Welfare

Exemption may be allowed if both the organization and the use of the property meet all of the requirements for the exemption.

BOE-268-B (FRONT) REV. 7 (8-07) EXM-229 (REV. 8-08)

1

1 2

2