Print and Reset Form

Reset Form

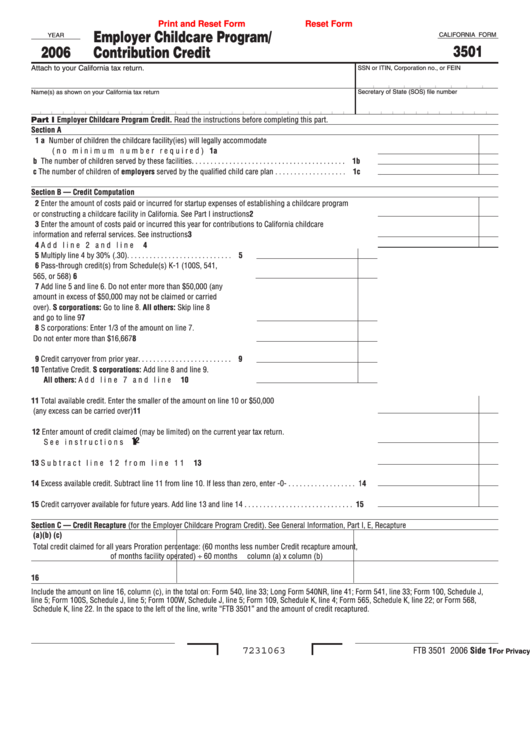

Employer Childcare Program/

CALIFORNIA FORM

YEAR

3501

2006

Contribution Credit

Attach to your California tax return.

SSN or ITIN, Corporation no., or FEIN

Secretary of State (SOS) file number

Name(s) as shown on your California tax return

Part I Employer Childcare Program Credit. Read the instructions before completing this part.

Section A

� a Number of children the childcare facility(ies) will legally accommodate

(no minimum number required). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . �a

b The number of children served by these facilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . �b

c The number of children of employers served by the qualified child care plan . . . . . . . . . . . . . . . . . . .

�c

Section B — Credit Computation

2 Enter the amount of costs paid or incurred for startup expenses of establishing a childcare program

or constructing a childcare facility in California. See Part I instructions. . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Enter the amount of costs paid or incurred this year for contributions to California childcare

information and referral services. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Add line 2 and line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Multiply line 4 by 30% (.30) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Pass-through credit(s) from Schedule(s) K-1 (100S, 541,

565, or 568) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Add line 5 and line 6. Do not enter more than $50,000 (any

amount in excess of $50,000 may not be claimed or carried

over). S corporations: Go to line 8. All others: Skip line 8

and go to line 9. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 S corporations: Enter 1/3 of the amount on line 7.

Do not enter more than $16,667 . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Credit carryover from prior year . . . . . . . . . . . . . . . . . . . . . . . . .

9

�0 Tentative Credit. S corporations: Add line 8 and line 9.

All others: Add line 7 and line 9 . . . . . . . . . . . . . . . . . . . . . . . . . �0

�� Total available credit. Enter the smaller of the amount on line 10 or $50,000

(any excess can be carried over) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ��

�2 Enter amount of credit claimed (may be limited) on the current year tax return.

�2

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

z

�3 Subtract line 12 from line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . �3

�4 Excess available credit. Subtract line 11 from line 10. If less than zero, enter -0- . . . . . . . . . . . . . . . . . . 14

�5 Credit carryover available for future years. Add line 13 and line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . �5

Section C — Credit Recapture (for the Employer Childcare Program Credit). See General Information, Part I, E, Recapture

(a)

(b)

(c)

Total credit claimed for all years

Proration percentage: (60 months less number

Credit recapture amount,

of months facility operated) ÷ 60 months

column (a) x column (b)

�6

Include the amount on line 16, column (c), in the total on: Form 540, line 33; Long Form 540NR, line 41; Form 541, line 33; Form 100, Schedule J,

line 5; Form 100S, Schedule J, line 5; Form 100W, Schedule J, line 5; Form 109, Schedule K, line 4; Form 565, Schedule K, line 22; or Form 568,

Schedule K, line 22. In the space to the left of the line, write “FTB 3501” and the amount of credit recaptured.

7231063

FTB 3501 2006 Side �

For Privacy Notice, get form FTB 1131.

1

1 2

2