Schedule M - Affiliated Entities Form - Montana Department Of Revenue

ADVERTISEMENT

MONTANA

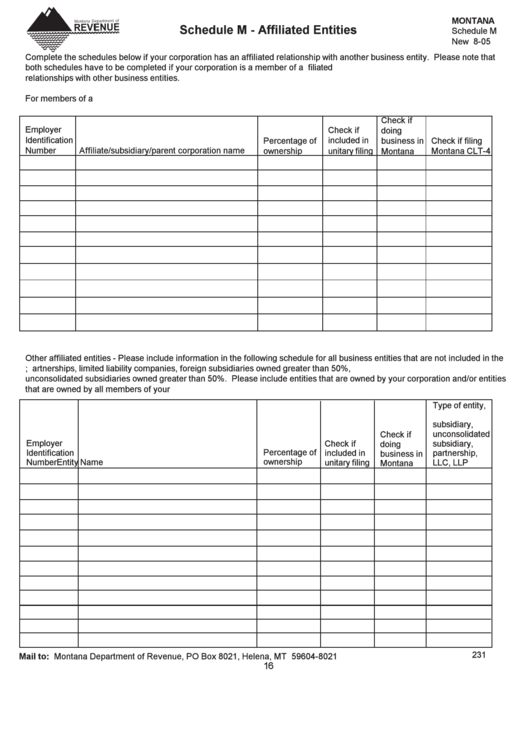

Schedule M - Affiliated Entities

Schedule M

New 8-05

Complete the schedules below if your corporation has an affiliated relationship with another business entity. Please note that

both schedules have to be completed if your corporation is a member of a U.S. consolidated group and has affiliated

relationships with other business entities.

For members of a U.S. consolidated group - Please include your information in the following schedule for all members of your

U.S. consolidated group.

Check if

Employer

Check if

doing

Identification

included in

Percentage of

business in

Check if filing

Number

Affiliate/subsidiary/parent corporation name

unitary filing

ownership

Montana

Montana CLT-4

Other affiliated entities - Please include information in the following schedule for all business entities that are not included in the

U.S. consolidated group; i.e. partnerships, limited liability companies, foreign subsidiaries owned greater than 50%,

unconsolidated subsidiaries owned greater than 50%. Please include entities that are owned by your corporation and/or entities

that are owned by all members of your U.S. consolidated group.

Type of entity,

i.e. foreign

subsidiary,

unconsolidated

Check if

Employer

Check if

subsidiary,

doing

Identification

Percentage of

included in

partnership,

business in

ownership

Number

Entity Name

unitary filing

LLC, LLP

Montana

231

Mail to: Montana Department of Revenue, PO Box 8021, Helena, MT 59604-8021

16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1