Instructions For Form St-101, Annual Schedule T

ADVERTISEMENT

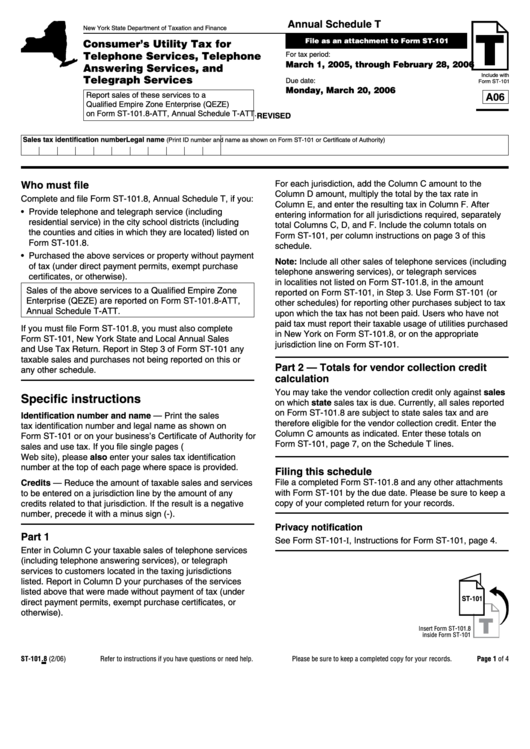

Annual Schedule T

New York State Department of Taxation and Finance

File as an attachment to Form ST-101

Consumer’s Utility Tax for

Telephone Services, Telephone

For tax period:

March 1, 2005, through February 28, 2006

Answering Services, and

Include with

Telegraph Services

Due date:

Form ST-101

Monday, March 20, 2006

Report sales of these services to a

A06

Qualified Empire Zone Enterprise (QEZE)

on Form ST-101.8-ATT, Annual Schedule T-ATT.

REVISED

Sales tax identification number

Legal name

(Print ID number and name as shown on Form ST-101 or Certificate of Authority)

Who must file

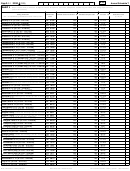

For each jurisdiction, add the Column C amount to the

Column D amount, multiply the total by the tax rate in

Complete and file Form ST-101.8, Annual Schedule T, if you:

Column E, and enter the resulting tax in Column F. After

• Provide telephone and telegraph service (including

entering information for all jurisdictions required, separately

residential service) in the city school districts (including

total Columns C, D, and F. Include the column totals on

the counties and cities in which they are located) listed on

Form ST-101, per column instructions on page 3 of this

Form ST-101.8.

schedule.

• Purchased the above services or property without payment

Note: Include all other sales of telephone services (including

of tax (under direct payment permits, exempt purchase

telephone answering services), or telegraph services

certificates, or otherwise).

in localities not listed on Form ST-101.8, in the amount

Sales of the above services to a Qualified Empire Zone

reported on Form ST-101, in Step 3. Use Form ST-101 (or

Enterprise (QEZE) are reported on Form ST-101.8-ATT,

other schedules) for reporting other purchases subject to tax

Annual Schedule T-ATT.

upon which the tax has not been paid. Users who have not

paid tax must report their taxable usage of utilities purchased

If you must file Form ST-101.8, you must also complete

in New York on Form ST-101.8, or on the appropriate

Form ST-101, New York State and Local Annual Sales

jurisdiction line on Form ST-101.

and Use Tax Return. Report in Step 3 of Form ST-101 any

taxable sales and purchases not being reported on this or

Part 2 — Totals for vendor collection credit

any other schedule.

calculation

You may take the vendor collection credit only against sales

Specific instructions

on which state sales tax is due. Currently, all sales reported

on Form ST-101.8 are subject to state sales tax and are

Identification number and name — Print the sales

therefore eligible for the vendor collection credit. Enter the

tax identification number and legal name as shown on

Column C amounts as indicated. Enter these totals on

Form ST-101 or on your business’s Certificate of Authority for

Form ST-101, page 7, on the Schedule T lines.

sales and use tax. If you file single pages (e.g. printed from

Web site), please also enter your sales tax identification

number at the top of each page where space is provided.

Filing this schedule

Credits — Reduce the amount of taxable sales and services

File a completed Form ST-101.8 and any other attachments

with Form ST-101 by the due date. Please be sure to keep a

to be entered on a jurisdiction line by the amount of any

copy of your completed return for your records.

credits related to that jurisdiction. If the result is a negative

number, precede it with a minus sign (-).

Privacy notification

Part 1

See Form ST-101-I, Instructions for Form ST-101, page 4.

Enter in Column C your taxable sales of telephone services

(including telephone answering services), or telegraph

services to customers located in the taxing jurisdictions

listed. Report in Column D your purchases of the services

listed above that were made without payment of tax (under

ST-101

direct payment permits, exempt purchase certificates, or

otherwise).

T

Insert Form ST‑101.8

inside Form ST‑101

ST-101.8 (2/06)

Refer to instructions if you have questions or need help.

Please be sure to keep a completed copy for your records.

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3