Instructions For Form 4136 - 2005

ADVERTISEMENT

3

Form 4136 (2005)

Page

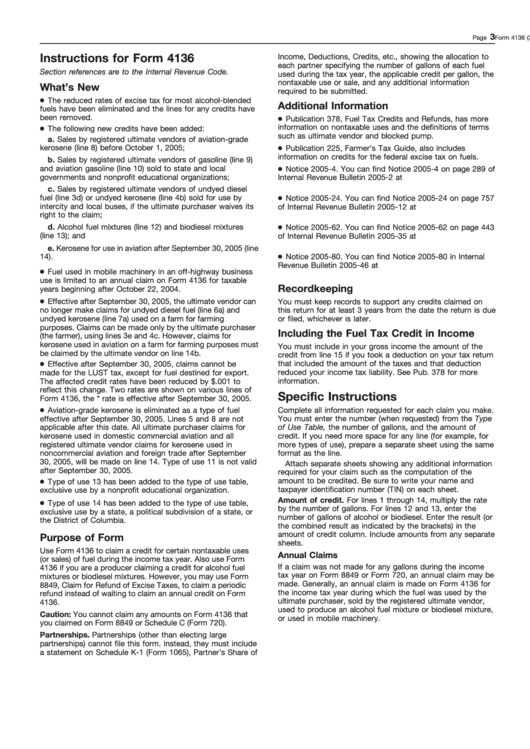

Instructions for Form 4136

Income, Deductions, Credits, etc., showing the allocation to

each partner specifying the number of gallons of each fuel

Section references are to the Internal Revenue Code.

used during the tax year, the applicable credit per gallon, the

nontaxable use or sale, and any additional information

What’s New

required to be submitted.

● The reduced rates of excise tax for most alcohol-blended

Additional Information

fuels have been eliminated and the lines for any credits have

● Publication 378, Fuel Tax Credits and Refunds, has more

been removed.

● The following new credits have been added:

information on nontaxable uses and the definitions of terms

such as ultimate vendor and blocked pump.

a. Sales by registered ultimate vendors of aviation-grade

● Publication 225, Farmer’s Tax Guide, also includes

kerosene (line 8) before October 1, 2005;

information on credits for the federal excise tax on fuels.

b. Sales by registered ultimate vendors of gasoline (line 9)

● Notice 2005-4. You can find Notice 2005-4 on page 289 of

and aviation gasoline (line 10) sold to state and local

governments and nonprofit educational organizations;

Internal Revenue Bulletin 2005-2 at

c. Sales by registered ultimate vendors of undyed diesel

● Notice 2005-24. You can find Notice 2005-24 on page 757

fuel (line 3d) or undyed kerosene (line 4b) sold for use by

intercity and local buses, if the ultimate purchaser waives its

of Internal Revenue Bulletin 2005-12 at

right to the claim;

● Notice 2005-62. You can find Notice 2005-62 on page 443

d. Alcohol fuel mixtures (line 12) and biodiesel mixtures

(line 13); and

of Internal Revenue Bulletin 2005-35 at

e. Kerosene for use in aviation after September 30, 2005 (line

● Notice 2005-80. You can find Notice 2005-80 in Internal

14).

Revenue Bulletin 2005-46 at

● Fuel used in mobile machinery in an off-highway business

use is limited to an annual claim on Form 4136 for taxable

Recordkeeping

years beginning after October 22, 2004.

● Effective after September 30, 2005, the ultimate vendor can

You must keep records to support any credits claimed on

no longer make claims for undyed diesel fuel (line 6a) and

this return for at least 3 years from the date the return is due

undyed kerosene (line 7a) used on a farm for farming

or filed, whichever is later.

purposes. Claims can be made only by the ultimate purchaser

Including the Fuel Tax Credit in Income

(the farmer), using lines 3e and 4c. However, claims for

kerosene used in aviation on a farm for farming purposes must

You must include in your gross income the amount of the

be claimed by the ultimate vendor on line 14b.

credit from line 15 if you took a deduction on your tax return

● Effective after September 30, 2005, claims cannot be

that included the amount of the taxes and that deduction

reduced your income tax liability. See Pub. 378 for more

made for the LUST tax, except for fuel destined for export.

information.

The affected credit rates have been reduced by $.001 to

reflect this change. Two rates are shown on various lines of

Specific Instructions

Form 4136, the * rate is effective after September 30, 2005.

● Aviation-grade kerosene is eliminated as a type of fuel

Complete all information requested for each claim you make.

effective after September 30, 2005. Lines 5 and 8 are not

You must enter the number (when requested) from the Type

applicable after this date. All ultimate purchaser claims for

of Use Table, the number of gallons, and the amount of

kerosene used in domestic commercial aviation and all

credit. If you need more space for any line (for example, for

registered ultimate vendor claims for kerosene used in

more types of use), prepare a separate sheet using the same

noncommercial aviation and foreign trade after September

format as the line.

30, 2005, will be made on line 14. Type of use 11 is not valid

Attach separate sheets showing any additional information

after September 30, 2005.

required for your claim such as the computation of the

● Type of use 13 has been added to the type of use table,

amount to be credited. Be sure to write your name and

taxpayer identification number (TIN) on each sheet.

exclusive use by a nonprofit educational organization.

Amount of credit. For lines 1 through 14, multiply the rate

● Type of use 14 has been added to the type of use table,

by the number of gallons. For lines 12 and 13, enter the

exclusive use by a state, a political subdivision of a state, or

number of gallons of alcohol or biodiesel. Enter the result (or

the District of Columbia.

the combined result as indicated by the brackets) in the

amount of credit column. Include amounts from any separate

Purpose of Form

sheets.

Use Form 4136 to claim a credit for certain nontaxable uses

Annual Claims

(or sales) of fuel during the income tax year. Also use Form

If a claim was not made for any gallons during the income

4136 if you are a producer claiming a credit for alcohol fuel

tax year on Form 8849 or Form 720, an annual claim may be

mixtures or biodiesel mixtures. However, you may use Form

made. Generally, an annual claim is made on Form 4136 for

8849, Claim for Refund of Excise Taxes, to claim a periodic

the income tax year during which the fuel was used by the

refund instead of waiting to claim an annual credit on Form

ultimate purchaser, sold by the registered ultimate vendor,

4136.

used to produce an alcohol fuel mixture or biodiesel mixture,

Caution: You cannot claim any amounts on Form 4136 that

or used in mobile machinery.

you claimed on Form 8849 or Schedule C (Form 720).

Partnerships. Partnerships (other than electing large

partnerships) cannot file this form. Instead, they must include

a statement on Schedule K-1 (Form 1065), Partner’s Share of

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4