Form 941/c1-Me - Combined Filing For Income Tax Withholding And Unemployment Contributions - 2011

ADVERTISEMENT

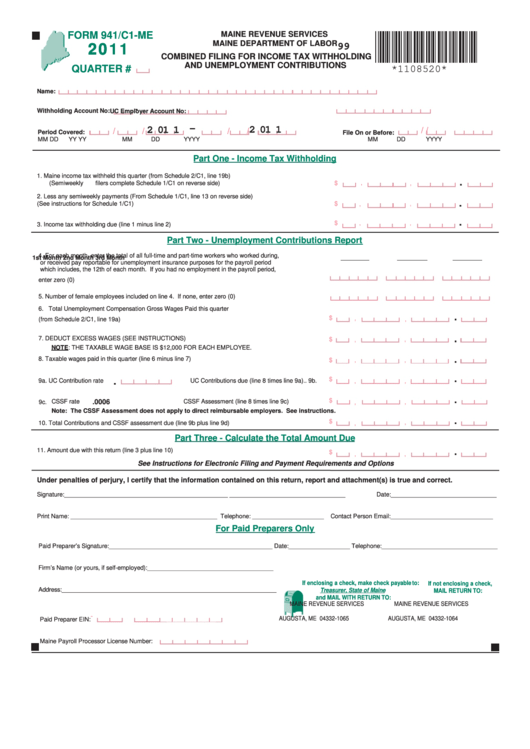

FORM 941/C1-ME

MAINE REVENUE SERVICES

2011

MAINE DEPARTMENT OF LABOR

99

COMBINED FILING FOR INCOME TAX WITHHOLDING

AND UNEMPLOYMENT CONTRIBUTIONS

QUARTER #

*1108520*

Name:

-

Withholding Account No:

UC Employer Account No:

-

2 0 1 1

2 0 1 1

/

/

/

/

/

/

Period Covered:

File On or Before:

MM

DD

YY YY

MM

DD

YYYY

MM

DD

YYYY

Part One - Income Tax Withholding

1.

Maine income tax withheld this quarter (from Schedule 2/C1, line 19b)

.

(Semiweekly fi lers complete Schedule 1/C1 on reverse side) ............................................................1.

$

,

,

2.

Less any semiweekly payments (From Schedule 1/C1, line 13 on reverse side)

.

(See instructions for Schedule 1/C1) ..................................................................................................2.

$

,

,

.

$

,

,

3.

Income tax withholding due (line 1 minus line 2) ................................................................................3.

Part Two - Unemployment Contributions Report

4.

For each month, enter the total of all full-time and part-time workers who worked during,

1st Month

2nd Month

3rd Month

or received pay reportable for unemployment insurance purposes for the payroll period

which includes, the 12th of each month. If you had no employment in the payroll period,

enter zero (0) .................................................................................................................................... 4.

5.

Number of female employees included on line 4. If none, enter zero (0) ......................................... 5.

6.

Total Unemployment Compensation Gross Wages Paid this quarter

.

$

,

(from Schedule 2/C1, line 19a) ........................................................................................................ 6.

,

.

7.

DEDUCT EXCESS WAGES (SEE INSTRUCTIONS) ....................................................................... 7.

$

,

,

NOTE: THE TAXABLE WAGE BASE IS $12,000 FOR EACH EMPLOYEE.

.

8.

Taxable wages paid in this quarter (line 6 minus line 7) .................................................................... 8.

$

,

,

.

.

$

9a. UC Contribution rate

UC Contributions due (line 8 times line 9a).. 9b.

,

,

.

$

CSSF rate

.0006

CSSF Assessment (line 8 times line 9c)............. 9d.

9c.

,

,

Note: The CSSF Assessment does not apply to direct reimbursable employers. See instructions.

.

$

,

10. Total Contributions and CSSF assessment due (line 9b plus line 9d)...............................................10.

,

Part Three - Calculate the Total Amount Due

11. Amount due with this return (line 3 plus line 10) ............................................................................. 11.

.

$

,

,

See Instructions for Electronic Filing and Payment Requirements and Options

Under penalties of perjury, I certify that the information contained on this return, report and attachment(s) is true and correct.

Signature:________________________________________________ __________________________________

Date:_______________________________

Print Name: ___________________________________________

Telephone: _____________________

Contact Person Email:______________________________

For Paid Preparers Only

Paid Preparer’s Signature:________________________________________________ Date:__________________ Telephone:__________________________________

Firm’s Name (or yours, if self-employed):_____________________________________

If enclosing a check, make check payable to:

If not enclosing a check,

Address:_______________________________________________________________

Treasurer, State of Maine

MAIL RETURN TO:

and MAIL WITH RETURN TO:

MAINE REVENUE SERVICES

MAINE REVENUE SERVICES

P.O. BOX 1065

P.O. BOX 1064

-

AUGUSTA, ME 04332-1065

AUGUSTA, ME 04332-1064

Paid Preparer EIN:

Maine Payroll Processor License Number:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3