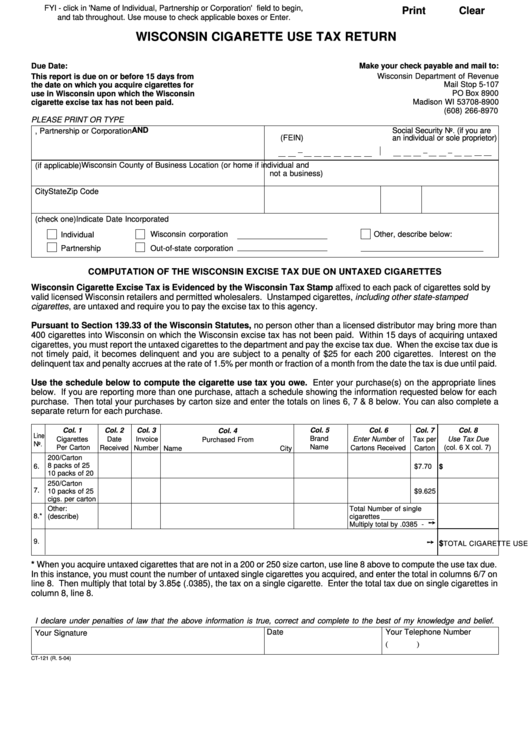

FYI - click in 'Name of Individual, Partnership or Corporation' field to begin,

Print

Clear

and tab throughout. Use mouse to check applicable boxes or Enter.

WISCONSIN CIGARETTE USE TAX RETURN

Make your check payable and mail to:

Due Date:

Wisconsin Department of Revenue

This report is due on or before 15 days from

Mail Stop 5-107

the date on which you acquire cigarettes for

PO Box 8900

use in Wisconsin upon which the Wisconsin

Madison WI 53708-8900

cigarette excise tax has not been paid.

(608) 266-8970

PLEASE PRINT OR TYPE

2. Federal Employer ID No. AND

Social Security No. (if you are

1. Name of Individual, Partnership or Corporation

(FEIN)

an individual or sole proprietor)

Wisconsin County of Business Location (or home if individual and

3. Business Name (if applicable)

not a business)

4. Mailing Address - Street or P.O. Box

City

State

Zip Code

5. Type of Organization (check one)

Indicate Date Incorporated

Other, describe below:

Wisconsin corporation

Individual

Partnership

Out-of-state corporation

COMPUTATION OF THE WISCONSIN EXCISE TAX DUE ON UNTAXED CIGARETTES

Wisconsin Cigarette Excise Tax is Evidenced by the Wisconsin Tax Stamp affixed to each pack of cigarettes sold by

valid licensed Wisconsin retailers and permitted wholesalers. Unstamped cigarettes, including other state-stamped

cigarettes, are untaxed and require you to pay the excise tax to this agency.

Pursuant to Section 139.33 of the Wisconsin Statutes, no person other than a licensed distributor may bring more than

400 cigarettes into Wisconsin on which the Wisconsin excise tax has not been paid. Within 15 days of acquiring untaxed

cigarettes, you must report the untaxed cigarettes to the department and pay the excise tax due. When the excise tax due is

not timely paid, it becomes delinquent and you are subject to a penalty of $25 for each 200 cigarettes. Interest on the

delinquent tax and penalty accrues at the rate of 1.5% per month or fraction of a month from the date the tax is due until paid.

Use the schedule below to compute the cigarette use tax you owe. Enter your purchase(s) on the appropriate lines

below. If you are reporting more than one purchase, attach a schedule showing the information requested below for each

purchase. Then total your purchases by carton size and enter the totals on lines 6, 7 & 8 below. You can also complete a

separate return for each purchase.

Col. 5

Col. 1

Col. 2

Col. 3

Col. 6

Col. 7

Col. 8

Col. 4

Line

Brand

Cigarettes

Date

Enter Number of

Use Tax Due

Invoice

Purchased From

Tax per

No.

Name

Per Carton

Received

Number

Cartons Received

Carton

(col. 6 X col. 7)

Name

City

200/Carton

8 packs of 25

6.

$7.70

$

10 packs of 20

250/Carton

7.

10 packs of 25

$9.625

cigs. per carton

Other:

Total Number of single

8.*

(describe)

cigarettes

➙

Multiply total by .0385 -

➙

9.

$

TOTAL CIGARETTE USE TAX DUE (add column 8 on lines 6, 7 & 8).

PAY WITH THIS RETURN

* When you acquire untaxed cigarettes that are not in a 200 or 250 size carton, use line 8 above to compute the use tax due.

In this instance, you must count the number of untaxed single cigarettes you acquired, and enter the total in columns 6/7 on

line 8. Then multiply that total by 3.85¢ (.0385), the tax on a single cigarette. Enter the total tax due on single cigarettes in

column 8, line 8.

I declare under penalties of law that the above information is true, correct and complete to the best of my knowledge and belief.

Date

Your Telephone Number

Your Signature

(

)

CT-121 (R. 5-04)

1

1