Print

Clear

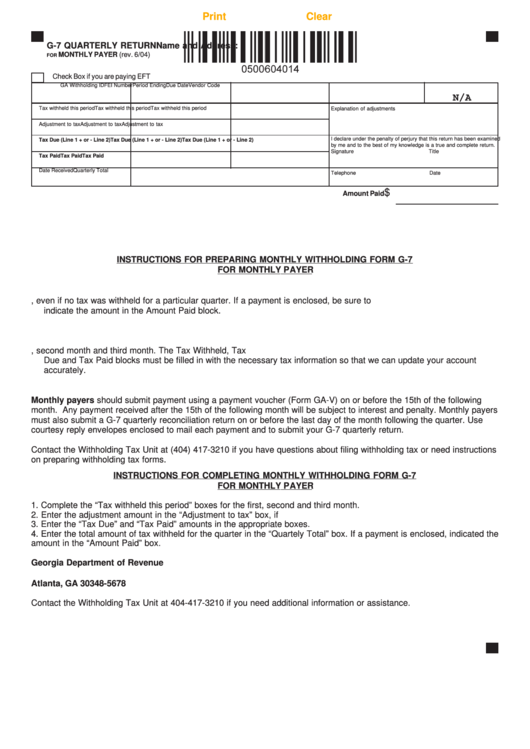

G-7 QUARTERLY RETURN

Name and Address:

MONTHLY PAYER (rev. 6/04)

FOR

Check Box if you are paying EFT

GA Withholding ID

FEI Number

Period Ending

Due Date

Vendor Code

N/A

Tax withheld this period

Tax withheld this period

Tax withheld this period

Explanation of adjustments

Adjustment to tax

Adjustment to tax

Adjustment to tax

I declare under the penalty of perjury that this return has been examined

Tax Due (Line 1 + or - Line 2)

Tax Due (Line 1 + or - Line 2)

Tax Due (Line 1 + or - Line 2)

by me and to the best of my knowledge is a true and complete return.

Signature

Title

Tax Paid

Tax Paid

Tax Paid

Date Received

Quarterly Total

Telephone

Date

$

Amount Paid

INSTRUCTIONS FOR PREPARING MONTHLY WITHHOLDING FORM G-7

FOR MONTHLY PAYER

1. Form G-7 must be filed, even if no tax was withheld for a particular quarter. If a payment is enclosed, be sure to

indicate the amount in the Amount Paid block.

2. Enter total amount of taxes withheld for the quarter in the Quarterly Total block.

3. Monthly payers should complete the sections for first month, second month and third month. The Tax Withheld, Tax

Due and Tax Paid blocks must be filled in with the necessary tax information so that we can update your account

accurately.

Monthly payers should submit payment using a payment voucher (Form GA-V) on or before the 15th of the following

month. Any payment received after the 15th of the following month will be subject to interest and penalty. Monthly payers

must also submit a G-7 quarterly reconciliation return on or before the last day of the month following the quarter. Use

courtesy reply envelopes enclosed to mail each payment and to submit your G-7 quarterly return.

Contact the Withholding Tax Unit at (404) 417-3210 if you have questions about filing withholding tax or need instructions

on preparing withholding tax forms.

INSTRUCTIONS FOR COMPLETING MONTHLY WITHHOLDING FORM G-7

FOR MONTHLY PAYER

1. Complete the “Tax withheld this period” boxes for the first, second and third month.

2. Enter the adjustment amount in the “Adjustment to tax” box, if applicable.Explain the adjustment where indicated.

3. Enter the “Tax Due” and “Tax Paid” amounts in the appropriate boxes.

4. Enter the total amount of tax withheld for the quarter in the “Quartely Total” box. If a payment is enclosed, indicated the

amount in the “Amount Paid” box.

Georgia Department of Revenue

P.O. Box 105678

Atlanta, GA 30348-5678

Contact the Withholding Tax Unit at 404-417-3210 if you need additional information or assistance.

1

1