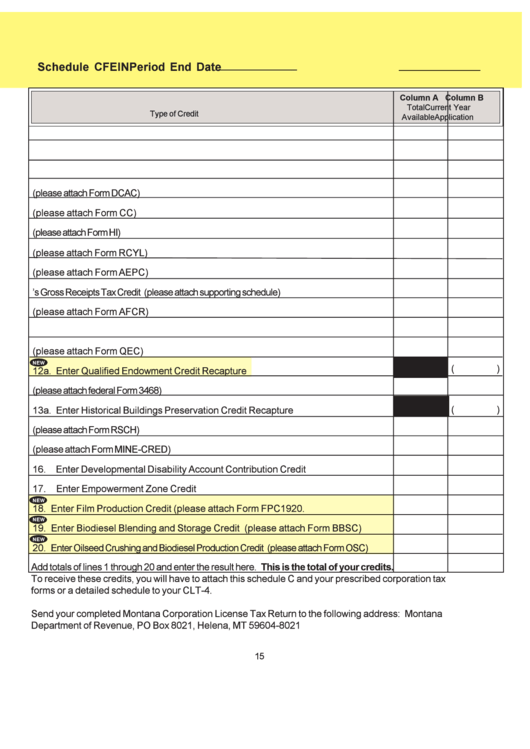

Schedule C

FEIN

Period End Date

Column A

Column B

Total

Current Year

Type of Credit

Available

Application

1.

Enter Montana Capital Company Credit

2.

Enter New/Expanded Industry Credit

3.

Enter Interest Differential Credit

4.

Enter Montana Dependent Care Assistance Credit (please attach Form DCAC)

5.

Enter Montana College Contribution Credit (please attach Form CC)

6.

Enter Health Insurance for Uninsured Montanans Credit (please attach Form HI)

7.

Enter Montana Recycle Credit (please attach Form RCYL)

8.

Enter Alternative Energy Production Credit (please attach Form AEPC)

9.

Enter Contractor’s Gross Receipts Tax Credit (please attach supporting schedule)

10. Enter Alternative Fuel Credit (please attach Form AFCR)

11. Enter Infrastructure Users Fee Credit

12. Enter Qualified Endowment Credit (please attach Form QEC)

NEW

(

)

12a. Enter Qualified Endowment Credit Recapture

13. Enter Historical Buildings Preservation Credit (please attach federal Form 3468)

(

)

13a. Enter Historical Buildings Preservation Credit Recapture

14. Enter Increase Research and Development Activities Credit (please attach Form RSCH)

15. Enter Mineral Exploration Incentive Credit (please attach Form MINE-CRED)

16. Enter Developmental Disability Account Contribution Credit

17. Enter Empowerment Zone Credit

NEW

18. Enter Film Production Credit (please attach Form FPC1920.

NEW

19. Enter Biodiesel Blending and Storage Credit (please attach Form BBSC)

NEW

20. Enter Oilseed Crushing and Biodiesel Production Credit (please attach Form OSC)

Add totals of lines 1 through 20 and enter the result here. This is the total of your credits.

To receive these credits, you will have to attach this schedule C and your prescribed corporation tax

forms or a detailed schedule to your CLT-4.

Send your completed Montana Corporation License Tax Return to the following address: Montana

Department of Revenue, PO Box 8021, Helena, MT 59604-8021

15

1

1