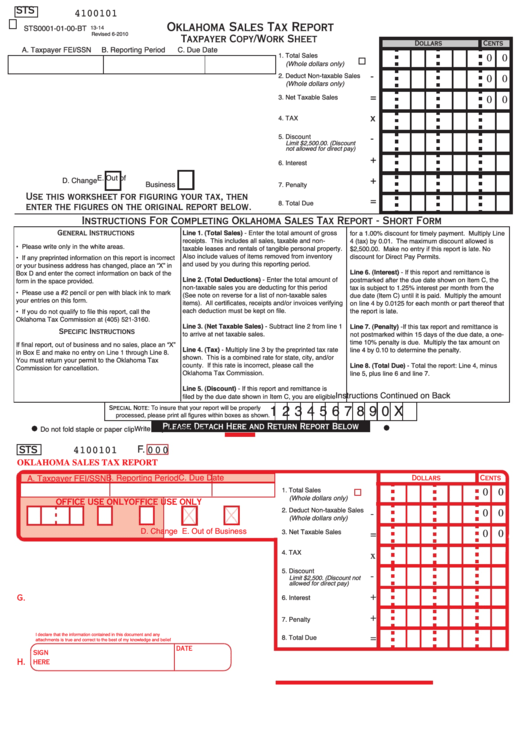

STS

4100101

Oklahoma Sales Tax Report

STS0001-01-00-BT

13-14

Revised 6-2010

Taxpayer Copy/Work Sheet

Dollars

Cents

A. Taxpayer FEI/SSN

B. Reporting Period

C. Due Date

1. Total Sales

0 0

(Whole dollars only)

-

2. Deduct Non-taxable Sales

0 0

(Whole dollars only)

=

3. Net Taxable Sales

0 0

x

4. TAX

5. Discount

-

Limit $2,500.00. (Discount

not allowed for direct pay)

+

6. Interest

E. Out of

+

D. Change

Business

7. Penalty

Use this worksheet for figuring your tax, then

=

8. Total Due

enter the figures on the original report below.

Instructions For Completing Oklahoma Sales Tax Report - Short Form

General Instructions

Line 1. (Total Sales) - Enter the total amount of gross

for a 1.00% discount for timely payment. Multiply Line

receipts. This includes all sales, taxable and non-

4 (tax) by 0.01. The maximum discount allowed is

• Please write only in the white areas.

taxable leases and rentals of tangible personal property.

$2,500.00. Make no entry if this report is late. No

Also include values of items removed from inventory

discount for Direct Pay Permits.

• If any preprinted information on this report is incorrect

and used by you during this reporting period.

or your business address has changed, place an “X” in

Line 6. (Interest) - If this report and remittance is

Box D and enter the correct information on back of the

Line 2. (Total Deductions) - Enter the total amount of

postmarked after the due date shown on Item C, the

form in the space provided.

non-taxable sales you are deducting for this period

tax is subject to 1.25% interest per month from the

• Please use a #2 pencil or pen with black ink to mark

(See note on reverse for a list of non-taxable sales

due date (Item C) until it is paid. Multiply the amount

your entries on this form.

items). All certificates, receipts and/or invoices verifying

on line 4 by 0.0125 for each month or part thereof that

each deduction must be kept on file.

the report is late.

• If you do not qualify to file this report, call the

Oklahoma Tax Commission at (405) 521-3160.

Line 3. (Net Taxable Sales) - Subtract line 2 from line 1

Line 7. (Penalty) -If this tax report and remittance is

Specific Instructions

to arrive at net taxable sales.

not postmarked within 15 days of the due date, a one-

time 10% penalty is due. Multiply the tax amount on

If final report, out of business and no sales, place an “X”

Line 4. (Tax) - Multiply line 3 by the preprinted tax rate

line 4 by 0.10 to determine the penalty.

in Box E and make no entry on Line 1 through Line 8.

shown. This is a combined rate for state, city, and/or

You must return your permit to the Oklahoma Tax

county. If this rate is incorrect, please call the

Line 8. (Total Due) - Total the report: Line 4, minus

Commission for cancellation.

Oklahoma Tax Commission.

line 5, plus line 6 and line 7.

Line 5. (Discount) - If this report and remittance is

Instructions Continued on Back

filed by the due date shown in Item C, you are eligible

Special Note: To insure that your report will be properly

1 2 3 4 5 6 7 8 9 0 X

processed, please print all figures within boxes as shown.

Please Detach Here and Return Report Below

Write only in white areas

Do not fold staple or paper clip

F. 0 0 0

4100101

STS

OKLAHOMA SALES TAX REPORT

C. Due Date

B. Reporting Period

A. Taxpayer FEI/SSN

Dollars

Cents

1. Total Sales

0 0

(Whole dollars only)

OFFICE USE ONLY

OFFICE USE ONLY

OFFICE USE ONLY

OFFICE USE ONLY

OFFICE USE ONLY

2. Deduct Non-taxable Sales

0 0

-

(Whole dollars only)

D. Change E. Out of Business

F.C.

F.C.

F.C.

F.C.

F.C.

P.T.

P.T.

P.T.

P.T.

P.T.

3. Net Taxable Sales

0 0

=

4. TAX

x

5. Discount

-

Limit $2,500. (Discount not

allowed for direct pay)

+

G.

6. Interest

+

7. Penalty

I declare that the information contained in this document and any

=

8. Total Due

attachments is true and correct to the best of my knowledge and belief

DATE

SIGN

H.

HERE

1

1 2

2