Press here to Print this Form

Reset Form

2009

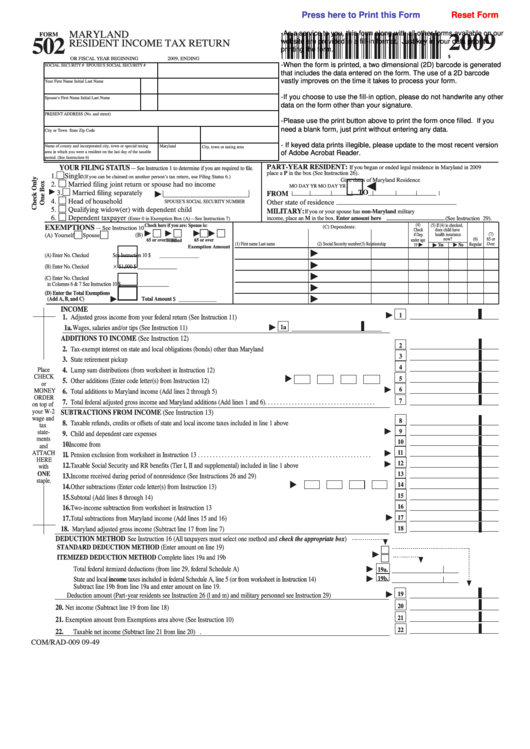

502

MARYLAND

FORM

-As a service to you, this form along with all other forms available on our

RESIDENT INCOME TAX RETURN

website are provided in a fill-in format. Just key in your data prior to

printing the form.

$

OR FISCAL YEAR BEGINNING

2009, ENDING

SOCIAL SECURITY #

SPOUSE'S SOCIAL SECURITY #

-When the form is printed, a two dimensional (2D) barcode is generated

that includes the data entered on the form. The use of a 2D barcode

Your First Name

Initial

Last Name

vastly improves on the time it takes to process your form.

Spouse's First Name

Initial

Last Name

-If you choose to use the fill-in option, please do not handwrite any other

data on the form other than your signature.

PRESENT ADDRESS (No. and street)

-Please use the print button above to print the form once filled. If you

City or Town

State

Zip Code

need a blank form, just print without entering any data.

Name of county and incorporated city, town or special taxing

- If keyed data prints illegible, please update to the most recent version

Maryland

City, town or taxing area

area in which you were a resident on the last day of the taxable

of Adobe Acrobat Reader.

period. (See Instruction 6)

PART-YEAR RESIDENT:

YOUR FIlINg STATUS

—

If you began or ended legal residence in Maryland in 2009

See Instruction 1 to determine if you are required to file.

place a P in the box (See Instruction 26).

Single

1.

(If you can be claimed on another person’s tax return, use Filing Status 6.)

Give dates of Maryland Residence

2.

Married filing joint return or spouse had no income

MO

DAY

YR

MO

DAY

YR

FROM _________________ TO ___________________

3.

Married filing separately

4.

Head of household

Other state of residence _________________________________

SPOUSE’S SOCIAL SECURITY NUMBER

5.

Qualifying widow(er) with dependent child

MIlITARY:

If you or your spouse has non-Maryland military

________________

6.

Dependent taxpayer

income, place an M in the box. Enter amount here

(See Instruction 29).

(Enter 0 in Exemption Box (A)—See Instruction 7 )

EXEMPTIONS

(4)

(5) If (4) is checked,

Check here if you are:

Spouse is:

—

See Instruction 10

(C) Dependents:

Check

does child have

(A) Yourself

Spouse

(B)

health insurance

(7)

if Dep.

now?

(6)

65 or

65 or over

65 or over

under age

Blind

Blind

(1) First name

Last name

(2) Social Security number

(3) Relationship

Regular

Over

19

No

Yes

Exemption Amount

(A) Enter No. Checked. . . . . . . . . .

See Instruction 10

$ ________________

(B) Enter No. Checked. . . . . . . . . .

$1,000

$ ________________

(C) Enter No. Checked

in Columns 6 & 7 . . . . . . . . . .

See Instruction 10

$ ________________

(D) Enter the Total Exemptions

(Add A, B, and C)

Total Amount

$ _____________

INCOME

1

1.

Adjusted gross income from your federal return (See Instruction 11). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1a.

1a

Wages, salaries and/or tips (See Instruction 11). . . . . . . . . . . . . . . . . . . . .

ADDITIONS TO INCOME (See Instruction 12)

2

2.

Tax-exempt interest on state and local obligations (bonds) other than Maryland. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3.

State retirement pickup . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4.

Place

Lump sum distributions (from worksheet in Instruction 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

CHECk

5

5.

Other additions (Enter code letter(s) from Instruction 12). . . . . . . . . . . . . . . . . . . . .

or

6

6.

MONEY

Total additions to Maryland income (Add lines 2 through 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

ORDER

7.

7

Total federal adjusted gross income and Maryland additions (Add lines 1 and 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

on top of

your W-2

SUBTRACTIONS FROM INCOME (See Instruction 13)

wage and

8

8.

Taxable refunds, credits or offsets of state and local income taxes included in line 1 above. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

tax

9

state-

9.

Child and dependent care expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

ments

10

10.

Income from U.S. obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

and

11

ATTACH

11.

Pension exclusion from worksheet in Instruction 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

HERE

12

12.

Taxable Social Security and RR benefits (Tier I, II and supplemental) included in line 1 above . . . . . . . . . . . . . . . . . . . . . . .

with

ONE

13

13.

Income received during period of nonresidence (See Instructions 26 and 29) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

staple.

14

14.

Other subtractions (Enter code letter(s) from Instruction 13) . . . . . . . . . . . . . . . . . . . .

15

15.

Subtotal (Add lines 8 through 14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16.

16

Two-income subtraction from worksheet in Instruction 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17.

17

Total subtractions from Maryland income (Add lines 15 and 16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18.

18

Maryland adjusted gross income (Subtract line 17 from line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

DEDUCTION METHOD

See Instruction 16 (All taxpayers must select one method and check the appropriate box)

STANDARD DEDUCTION METHOD (Enter amount on line 19)

ITEMIZED DEDUCTION METHOD Complete lines 19a and 19b

Total federal itemized deductions (from line 29, federal Schedule A). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19a.

State and local income taxes included in federal Schedule A, line 5 (or from worksheet in Instruction 14) . . . . . . . . . . . . .

19b.

Subtract line 19b from line 19a and enter amount on line 19.

19

Deduction amount (Part-year residents see Instruction 26 (l and m) and military personnel see Instruction 29) . . . . . . . . . . . . .

20

20.

Net income (Subtract line 19 from line 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

21.

Exemption amount from Exemptions area above (See Instruction 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

22.

Taxable net income (Subtract line 21 from line 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

COM/RAD-009

09-49

1

1 2

2