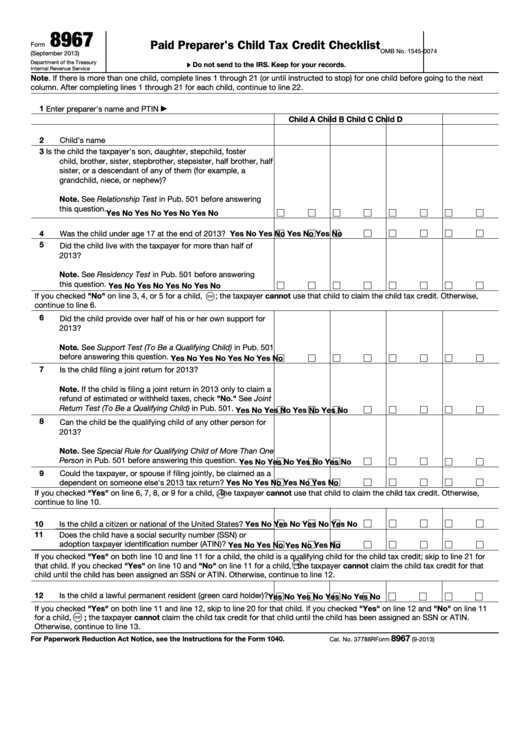

8967

Paid Preparer's Child Tax Credit Checklist

Form

OMB No. 1545-0074

(September 2013)

Department of the Treasury

▶

Do not send to the IRS. Keep for your records

.

Internal Revenue Service

Note. If there is more than one child, complete lines 1 through 21 (or until instructed to stop) for one child before going to the next

column. After completing lines 1 through 21 for each child, continue to line 22.

1

Enter preparer's name and PTIN

▶

Child A

Child B

Child C

Child D

2

Child’s name

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

Is the child the taxpayer's son, daughter, stepchild, foster

child, brother, sister, stepbrother, stepsister, half brother, half

sister, or a descendant of any of them (for example, a

grandchild, niece, or nephew)?

Note. See Relationship Test in Pub. 501 before answering

this question.

Yes

No

Yes

No

Yes

No

Yes

No

4

Was the child under age 17 at the end of 2013?

Yes

No

Yes

No

Yes

No

Yes

No

5

Did the child live with the taxpayer for more than half of

2013?

Note. See Residency Test in Pub. 501 before answering

this question.

Yes

No

Yes

No

Yes

No

Yes

No

If you checked "No" on line 3, 4, or 5 for a child,

; the taxpayer cannot use that child to claim the child tax credit. Otherwise,

continue to line 6.

6

Did the child provide over half of his or her own support for

2013?

Note. See Support Test (To Be a Qualifying Child) in Pub. 501

before answering this question.

Yes

No

Yes

No

Yes

No

Yes

No

7

Is the child filing a joint return for 2013?

Note. If the child is filing a joint return in 2013 only to claim a

refund of estimated or withheld taxes, check "No." See Joint

Return Test (To Be a Qualifying Child) in Pub. 501.

Yes

No

Yes

No

Yes

No

Yes

No

8

Can the child be the qualifying child of any other person for

2013?

Note. See Special Rule for Qualifying Child of More Than One

Person in Pub. 501 before answering this question.

Yes

No

Yes

No

Yes

No

Yes

No

9

Could the taxpayer, or spouse if filing jointly, be claimed as a

dependent on someone else's 2013 tax return?

Yes

No

Yes

No

Yes

No

Yes

No

If you checked "Yes" on line 6, 7, 8, or 9 for a child,

; the taxpayer cannot use that child to claim the child tax credit. Otherwise,

continue to line 10.

10

Yes

No

Yes

No

Yes

No

Yes

No

Is the child a citizen or national of the United States?

11

Does the child have a social security number (SSN) or

adoption taxpayer identification number (ATIN)?

Yes

No

Yes

No

Yes

No

Yes

No

If you checked "Yes" on both line 10 and line 11 for a child, the child is a qualifying child for the child tax credit; skip to line 21 for

that child. If you checked "Yes" on line 10 and "No" on line 11 for a child,

; the taxpayer cannot claim the child tax credit for that

child until the child has been assigned an SSN or ATIN. Otherwise, continue to line 12.

12

Is the child a lawful permanent resident (green card holder)?

Yes

No

Yes

No

Yes

No

Yes

No

If you checked "Yes" on both line 11 and line 12, skip to line 20 for that child. If you checked "Yes" on line 12 and "No" on line 11

for a child,

; the taxpayer cannot claim the child tax credit for that child until the child has been assigned an SSN or ATIN.

Otherwise, continue to line 13.

8967

For Paperwork Reduction Act Notice, see the Instructions for the Form 1040.

Cat. No. 37788R

Form

(9-2013)

1

1 2

2 3

3