Form Tr-125 - Instructions For Voluntary Dissolution Of New York State Business Corporations

ADVERTISEMENT

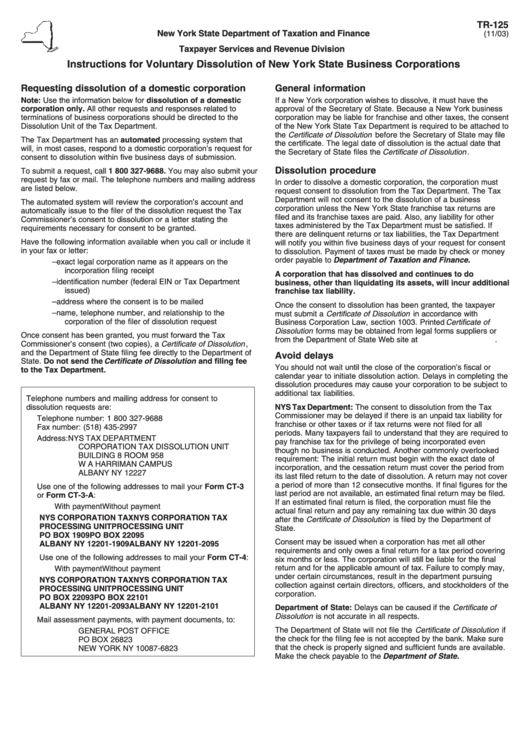

TR-125

New York State Department of Taxation and Finance

(11/03)

Taxpayer Services and Revenue Division

Instructions for Voluntary Dissolution of New York State Business Corporations

Requesting dissolution of a domestic corporation

General information

Note: Use the information below for dissolution of a domestic

If a New York corporation wishes to dissolve, it must have the

corporation only. All other requests and responses related to

approval of the Secretary of State. Because a New York business

terminations of business corporations should be directed to the

corporation may be liable for franchise and other taxes, the consent

Dissolution Unit of the Tax Department.

of the New York State Tax Department is required to be attached to

the Certificate of Dissolution before the Secretary of State may file

The Tax Department has an automated processing system that

the certificate. The legal date of dissolution is the actual date that

will, in most cases, respond to a domestic corporation’s request for

the Secretary of State files the Certificate of Dissolution .

consent to dissolution within five business days of submission.

Dissolution procedure

To submit a request, call 1 800 327-9688. You may also submit your

request by fax or mail. The telephone numbers and mailing address

In order to dissolve a domestic corporation, the corporation must

are listed below.

request consent to dissolution from the Tax Department. The Tax

Department will not consent to the dissolution of a business

The automated system will review the corporation’s account and

corporation unless the New York State franchise tax returns are

automatically issue to the filer of the dissolution request the Tax

filed and its franchise taxes are paid. Also, any liability for other

Commissioner’s consent to dissolution or a letter stating the

taxes administered by the Tax Department must be satisfied. If

requirements necessary for consent to be granted.

there are delinquent returns or tax liabilities, the Tax Department

Have the following information available when you call or include it

will notify you within five business days of your request for consent

in your fax or letter:

to dissolution. Payment of taxes must be made by check or money

order payable to Department of Taxation and Finance.

–

exact legal corporation name as it appears on the

incorporation filing receipt

A corporation that has dissolved and continues to do

–

identification number (federal EIN or Tax Department

business, other than liquidating its assets, will incur additional

issued)

franchise tax liability.

–

address where the consent is to be mailed

Once the consent to dissolution has been granted, the taxpayer

–

name, telephone number, and relationship to the

must submit a Certificate of Dissolution in accordance with

corporation of the filer of dissolution request

Business Corporation Law, section 1003. Printed Certificate of

Dissolution forms may be obtained from legal forms suppliers or

Once consent has been granted, you must forward the Tax

from the Department of State Web site at .

Commissioner’s consent (two copies), a Certificate of Dissolution ,

and the Department of State filing fee directly to the Department of

Avoid delays

State. Do not send the Certificate of Dissolution and filing fee

You should not wait until the close of the corporation’s fiscal or

to the Tax Department.

calendar year to initiate dissolution action. Delays in completing the

dissolution procedures may cause your corporation to be subject to

additional tax liabilities.

Telephone numbers and mailing address for consent to

dissolution requests are:

NYS Tax Department: The consent to dissolution from the Tax

Commissioner may be delayed if there is an unpaid tax liability for

Telephone number: 1 800 327-9688

franchise or other taxes or if tax returns were not filed for all

Fax number: (518) 435-2997

periods. Many taxpayers fail to understand that they are required to

Address:

NYS TAX DEPARTMENT

pay franchise tax for the privilege of being incorporated even

CORPORATION TAX DISSOLUTION UNIT

though no business is conducted. Another commonly overlooked

BUILDING 8 ROOM 958

requirement: The initial return must begin with the exact date of

W A HARRIMAN CAMPUS

incorporation, and the cessation return must cover the period from

ALBANY NY 12227

its last filed return to the date of dissolution. A return may not cover

a period of more than 12 consecutive months. If final figures for the

Use one of the following addresses to mail your Form CT-3

last period are not available, an estimated final return may be filed.

or Form CT-3-A:

If an estimated final return is filed, the corporation must file the

With payment

Without payment

actual final return and pay any remaining tax due within 30 days

NYS CORPORATION TAX

NYS CORPORATION TAX

after the Certificate of Dissolution is filed by the Department of

PROCESSING UNIT

PROCESSING UNIT

State.

PO BOX 1909

PO BOX 22095

Consent may be issued when a corporation has met all other

ALBANY NY 12201-1909

ALBANY NY 12201-2095

requirements and only owes a final return for a tax period covering

Use one of the following addresses to mail your Form CT-4:

six months or less. The corporation will still be liable for the final

return and for the applicable amount of tax. Failure to comply may,

With payment

Without payment

under certain circumstances, result in the department pursuing

NYS CORPORATION TAX

NYS CORPORATION TAX

collection against certain directors, officers, and stockholders of the

PROCESSING UNIT

PROCESSING UNIT

corporation.

PO BOX 22093

PO BOX 22101

ALBANY NY 12201-2093

ALBANY NY 12201-2101

Department of State: Delays can be caused if the Certificate of

Dissolution is not accurate in all respects.

Mail assessment payments, with payment documents, to:

The Department of State will not file the Certificate of Dissolution if

GENERAL POST OFFICE

the check for the filing fee is not accepted by the bank. Make sure

PO BOX 26823

that the check is properly signed and sufficient funds are available.

NEW YORK NY 10087-6823

Make the check payable to the Department of State.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2