Department of Revenue Services

Reset Form

State of Connecticut

(Rev. 02/08)

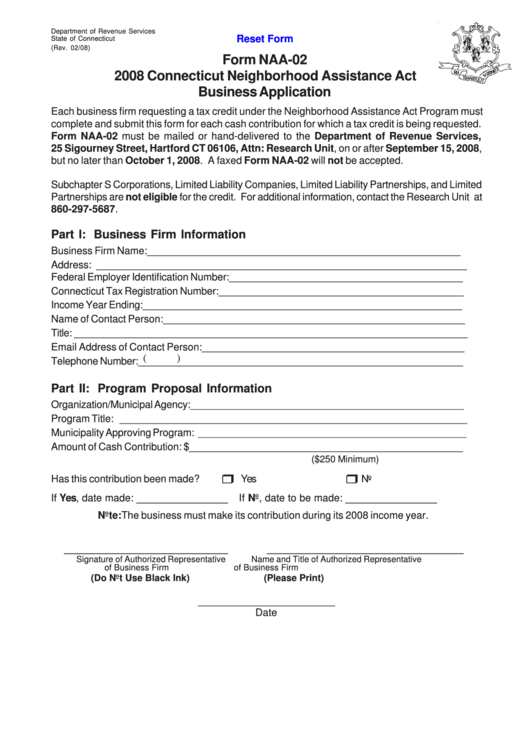

Form NAA-02

2008 Connecticut Neighborhood Assistance Act

Business Application

Each business firm requesting a tax credit under the Neighborhood Assistance Act Program must

complete and submit this form for each cash contribution for which a tax credit is being requested.

Form NAA-02 must be mailed or hand-delivered to the Department of Revenue Services,

25 Sigourney Street, Hartford CT 06106, Attn: Research Unit, on or after September 15, 2008,

but no later than October 1, 2008. A faxed Form NAA-02 will not be accepted.

Subchapter S Corporations, Limited Liability Companies, Limited Liability Partnerships, and Limited

Partnerships are not eligible for the credit. For additional information, contact the Research Unit at

860-297-5687.

Part I: Business Firm Information

Business Firm Name: _______________________________________________________

Address: _________________________________________________________________

Federal Employer Identification Number: _________________________________________

Connecticut Tax Registration Number: ___________________________________________

Income Year Ending: ________________________________________________________

Name of Contact Person: _____________________________________________________

Title: _____________________________________________________________________

Email Address of Contact Person: ______________________________________________

(

)

Telephone Number: _________________________________________________________

Part II: Program Proposal Information

Organization/Municipal Agency: ________________________________________________

Program Title: _____________________________________________________________

Municipality Approving Program: _______________________________________________

Amount of Cash Contribution: $ ________________________________________________

($250 Minimum)

Has this contribution been made?

Yes

No

______________

______________

If Yes, date made:

If No, date to be made:

Note: The business must make its contribution during its 2008 income year.

_________________________

______________________________

Signature of Authorized Representative

Name and Title of Authorized Representative

of Business Firm

of Business Firm

(Do Not Use Black Ink)

(Please Print)

________________________

Date

1

1