Form Ia-336 - Freight Car Line Companies

ADVERTISEMENT

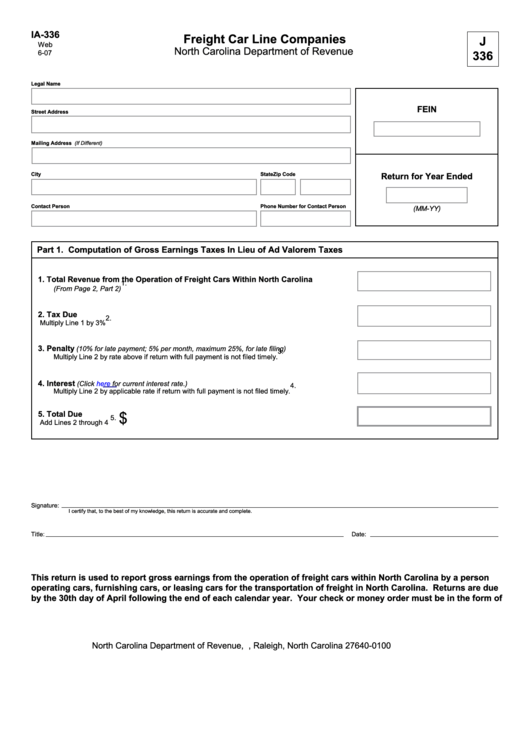

IA-336

Freight Car Line Companies

J

Web

North Carolina Department of Revenue

336

6-07

Legal Name

FEIN

Street Address

Mailing Address (If Different)

City

State

Zip Code

Return for Year Ended

Contact Person

Phone Number for Contact Person

(MM-YY)

Part 1. Computation of Gross Earnings Taxes In Lieu of Ad Valorem Taxes

1.

Total Revenue from the Operation of Freight Cars Within North Carolina

1.

(From Page 2, Part 2)

2.

Tax Due

2.

Multiply Line 1 by 3%

3.

Penalty

(10% for late payment; 5% per month, maximum 25%, for late filing)

3.

Multiply Line 2 by rate above if return with full payment is not filed timely.

4.

Interest

(Click

here

for current interest rate.)

4.

Multiply Line 2 by applicable rate if return with full payment is not filed timely.

$

5.

Total Due

5.

Add Lines 2 through 4

Signature:

I certify that, to the best of my knowledge, this return is accurate and complete.

Title:

Date:

This return is used to report gross earnings from the operation of freight cars within North Carolina by a person

operating cars, furnishing cars, or leasing cars for the transportation of freight in North Carolina. Returns are due

by the 30th day of April following the end of each calendar year. Your check or money order must be in the form of

U.S. currency from a domestic bank.

North Carolina Department of Revenue, P.O. Box 25000, Raleigh, North Carolina 27640-0100

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2