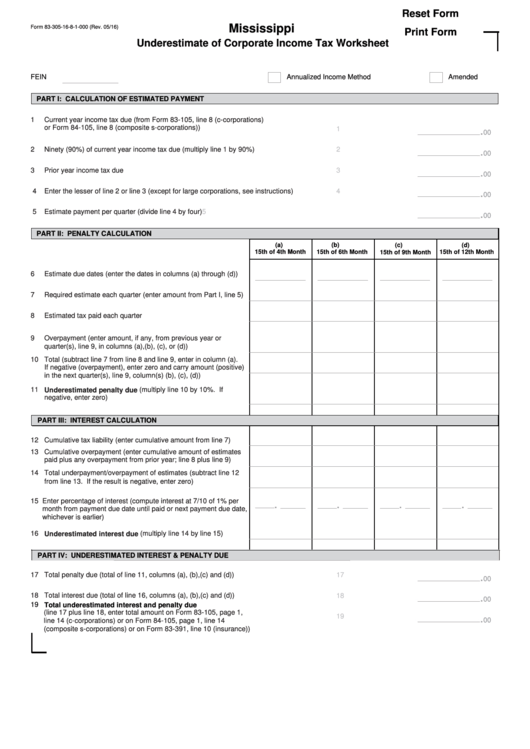

Reset Form

Mississippi

Form 83-305-16-8-1-000 (Rev. 05/16)

Print Form

Underestimate of Corporate Income Tax Worksheet

FEIN

Annualized Income Method

Amended

PART I: CALCULATION OF ESTIMATED PAYMENT

1

Current year income tax due (from Form 83-105, line 8 (c-corporations)

or Form 84-105, line 8 (composite s-corporations))

1

.

00

2

Ninety (90%) of current year income tax due (multiply line 1 by 90%)

2

.

00

3

Prior year income tax due

3

.

00

4

Enter the lesser of line 2 or line 3 (except for large corporations, see instructions)

4

.

00

5

Estimate payment per quarter (divide line 4 by four)

5

.

00

PART II: PENALTY CALCULATION

(a)

(b)

(d)

(c)

15th of 4th Month

15th of 6th Month

15th of 9th Month

15th of 12th Month

6

Estimate due dates (enter the dates in columns (a) through (d))

7

Required estimate each quarter (enter amount from Part I, line 5)

8

Estimated tax paid each quarter

9

Overpayment (enter amount, if any, from previous year or

quarter(s), line 9, in columns (a),(b), (c), or (d))

10 Total (subtract line 7 from line 8 and line 9, enter in column (a).

If negative (overpayment), enter zero and carry amount (positive)

in the next quarter(s), line 9, column(s) (b), (c), (d))

11 Underestimated penalty due (multiply line 10 by 10%. If

negative, enter zero)

PART III: INTEREST CALCULATION

12 Cumulative tax liability (enter cumulative amount from line 7)

13 Cumulative overpayment (enter cumulative amount of estimates

paid plus any overpayment from prior year; line 8 plus line 9)

14 Total underpayment/overpayment of estimates (subtract line 12

from line 13. If the result is negative, enter zero)

15 Enter percentage of interest (compute interest at 7/10 of 1% per

.

.

.

.

month from payment due date until paid or next payment due date,

whichever is earlier)

16 Underestimated interest due (multiply line 14 by line 15)

PART IV: UNDERESTIMATED INTEREST & PENALTY DUE

17 Total penalty due (total of line 11, columns (a), (b),(c) and (d))

17

.

00

18 Total interest due (total of line 16, columns (a), (b),(c) and (d))

18

.

00

19 Total underestimated interest and penalty due

(line 17 plus line 18, enter total amount on Form 83-105, page 1,

19

.

00

line 14 (c-corporations) or on Form 84-105, page 1, line 14

(composite s-corporations) or on Form 83-391, line 10 (insurance))

1

1