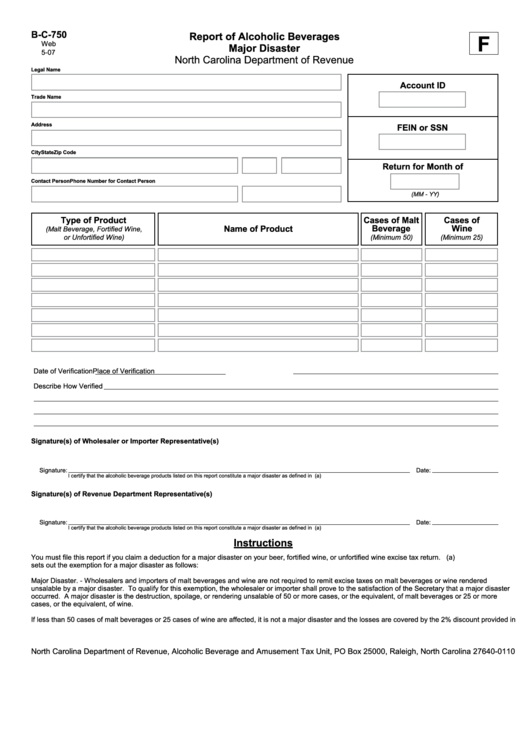

Form B-C-750 - Report Of Alcoholic Beverages - Major Disaster

ADVERTISEMENT

B-C-750

Report of Alcoholic Beverages

F

Web

Major Disaster

5-07

North Carolina Department of Revenue

Legal Name

Account ID

Trade Name

Address

FEIN or SSN

City

State

Zip Code

Return for Month of

Contact Person

Phone Number for Contact Person

(MM - YY)

Type of Product

Cases of Malt

Cases of

Beverage

Wine

Name of Product

(Malt Beverage, Fortified Wine,

or Unfortified Wine)

(Minimum 50)

(Minimum 25)

Date of Verification

Place of Verification

Describe How Verified

Signature(s) of Wholesaler or Importer Representative(s)

Signature:

Date:

I certify that the alcoholic beverage products listed on this report constitute a major disaster as defined in G.S. 105-113.81(a)

Signature(s) of Revenue Department Representative(s)

Signature:

Date:

I certify that the alcoholic beverage products listed on this report constitute a major disaster as defined in G.S. 105-113.81(a)

Instructions

You must file this report if you claim a deduction for a major disaster on your beer, fortified wine, or unfortified wine excise tax return. G.S. 105-113.81(a)

sets out the exemption for a major disaster as follows:

Major Disaster. - Wholesalers and importers of malt beverages and wine are not required to remit excise taxes on malt beverages or wine rendered

unsalable by a major disaster. To qualify for this exemption, the wholesaler or importer shall prove to the satisfaction of the Secretary that a major disaster

occurred. A major disaster is the destruction, spoilage, or rendering unsalable of 50 or more cases, or the equivalent, of malt beverages or 25 or more

cases, or the equivalent, of wine.

If less than 50 cases of malt beverages or 25 cases of wine are affected, it is not a major disaster and the losses are covered by the 2% discount provided in

G.S. 105-113.85. A major disaster is caused by one event and an accumulation of products to reach the 50 cases or 25 cases threshold is not allowable.

North Carolina Department of Revenue, Alcoholic Beverage and Amusement Tax Unit, PO Box 25000, Raleigh, North Carolina 27640-0110

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1