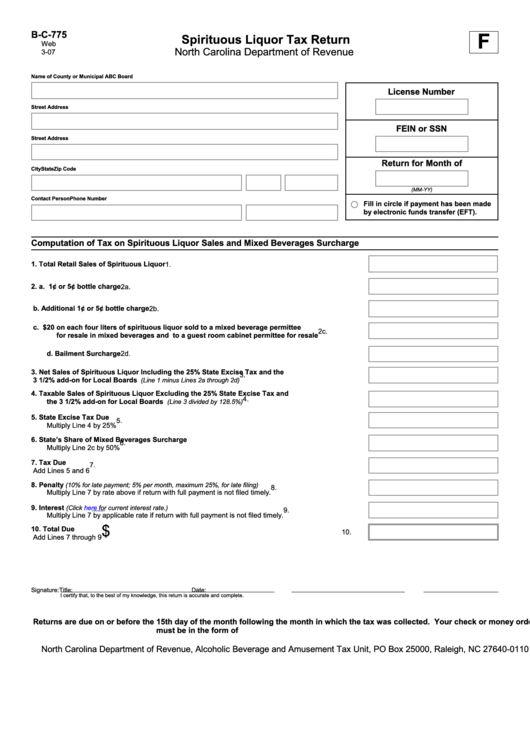

Form B-C-775 - Spirituous Liquor Tax Return

ADVERTISEMENT

F

B-C-775

Spirituous Liquor Tax Return

Web

North Carolina Department of Revenue

3-07

Name of County or Municipal ABC Board

License Number

Street Address

FEIN or SSN

Street Address

Return for Month of

City

State

Zip Code

(MM-YY)

Contact Person

Phone Number

Fill in circle if payment has been made

by electronic funds transfer (EFT).

Computation of Tax on Spirituous Liquor Sales and Mixed Beverages Surcharge

1.

Total Retail Sales of Spirituous Liquor

1.

2.

a. 1¢ or 5¢ bottle charge

2a.

b. Additional 1¢ or 5¢ bottle charge

2b.

c. $20 on each four liters of spirituous liquor sold to a mixed beverage permittee

2c.

for resale in mixed beverages and to a guest room cabinet permittee for resale

d. Bailment Surcharge

2d.

3.

Net Sales of Spirituous Liquor Including the 25% State Excise Tax and the

3.

3 1/2% add-on for Local Boards

(Line 1 minus Lines 2a through 2d)

4.

Taxable Sales of Spirituous Liquor Excluding the 25% State Excise Tax and

4.

the 3 1/2% add-on for Local Boards

(Line 3 divided by 128.5%)

5.

State Excise Tax Due

5.

Multiply Line 4 by 25%

6.

State’s Share of Mixed Beverages Surcharge

6.

Multiply Line 2c by 50%

7.

Tax Due

7.

Add Lines 5 and 6

8.

Penalty

(10% for late payment; 5% per month, maximum 25%, for late filing)

8.

Multiply Line 7 by rate above if return with full payment is not filed timely.

9.

Interest

(Click

here

for current interest rate.)

9.

Multiply Line 7 by applicable rate if return with full payment is not filed timely.

$

10. Total Due

10.

Add Lines 7 through 9

Signature:

Title:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

Returns are due on or before the 15th day of the month following the month in which the tax was collected. Your check or money order

must be in the form of U.S. currency from a domestic bank.

North Carolina Department of Revenue, Alcoholic Beverage and Amusement Tax Unit, PO Box 25000, Raleigh, NC 27640-0110

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1