Uniform Business Report (Ubr) Instructions

ADVERTISEMENT

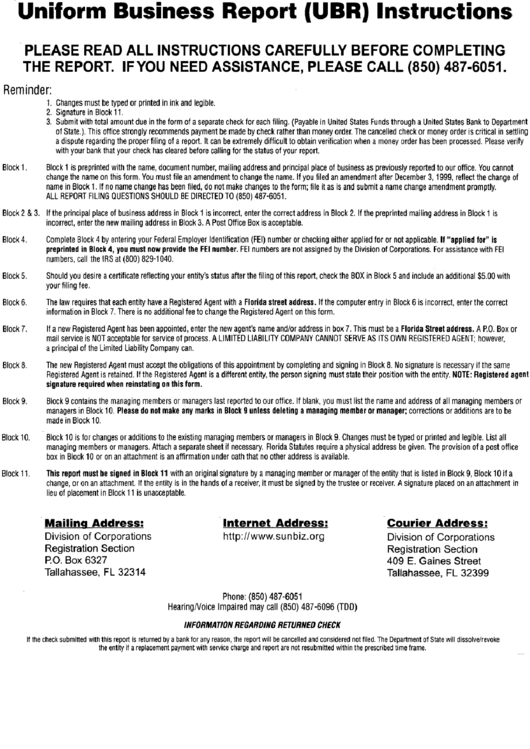

Uniform Business Report (UBR) Instructions

Block 1.

Block 2 & 3.

Block 4.

Block 5.

Block 6.

Block 7.

Block 8.

Block 9.

Block 10.

Block 11.

PLEASE READ ALL INSTRUCTIONS CAREFULLY BEFORE COMPLETING

THE REPORT. IF YOU NEED ASSISTANCE, PLEASE CALL (850) 487-6051.

Reminder:

1. Changes must be typed or printed in ink and legible.

2. Signature in Block 11.

3. Submit with total amount due in the form of a separate check for each filing. (Payable in United States Funds through a United States Bank to Department

of State.). This office strongly recommends payment be made by check rather than money order. The cancelled check or money order is critical in settling

a dispute regarding the proper filing of a report. It can be extremely difficult to obtain verification when a money order has been processed. Please verify

with your bank that your check has cleared before calling for the status of your report.

Block 1 is preprinted with the name, document number, mailing address and principal place of business as previously reported to our office. You cannot

change the name on this form. You must file an amendment to change the name. If you filed an amendment after December 3, 1999, reflect the change of

name in Block 1. If no name change has been filed, do not make changes to the form; file it as is and submit a name change amendment promptly.

ALL REPORT FILING QUESTIONS SHOULD BE DIRECTED TO (850) 487-6051.

If the principal place of business address in Block 1 is incorrect, enter the correct address in Block 2. If the preprinted mailing address in Block 1 is

incorrect, enter the new mailing address in Block 3. A Post Office Box is acceptable.

Complete Block 4 by entering your Federal Employer Identification (FEI) number or checking either applied for or not applicable. I1 "applied for" is

preprinted in Block 4, you must now provide the FEI number. FEI numbers are not assigned by the Division of Corporations. For assistance with FEI

numbers, call the IRS at (800) 829-1040.

Should you desire a certificate reflecting your entity's status after the filing of this report, check the BOX in Block 5 and include an additional $5.00 with

your filing fee.

The law requires that each entity have a Registered Agent with a Florida street address. If the computer entry in Block 6 is incorrect, enter the correct

information in Block 7. There is no additional fee to change the Registered Agent on this form.

If a new Registered Agent has been appointed, enter the new agent's name and/or address in box 7. This must be a Florida Street address. A P.O. Box or

mail service is NOT acceptable for service of process. A LIMITED LIABILITY COMPANY CANNOT SERVE AS ITS OWN REGISTERED AGENT; however,

a principal of the Limited Liability Company can.

The new Registered Agent must accept the obligations of this appointment by completing and signing in Block 8. No signature is necessary if the same

Registered Agent is retained. If the Registered Agent is a different entity, the person signing must state their position with the entity. NOTE: Registered agent

signature required when reinstating on this form.

Block 9 contains the managing members or managers last reported to our office. If blank, you must list the name and address of all managing members or

managers in Block 10. Please do not make any marks in Block 9 unless deleting a managing member or manager; corrections or additions are to be

made in Block 10.

Block 10 is for changes or additions to the existing managing members or managers in Block 9. Changes must be typed or printed and legible. List all

managing members or managers. Attach a separate sheet if necessary. Florida Statutes require a physical address be given. The provision of a post office

box in Block 10 or on an attachment is an affirmation under oath that no other address is available.

This report must be signed in Block 11 with an original signature by a managing member or manager of the entity that is listed in Block 9, Block 10 if a

change, or on an attachment. If the entity is in the hands of a receiver, it must be signed by the trustee or receiver. A signature placed on an attachment in

lieu of placement in Block 11 is unacceptable.

M a i l i n q

A d d r e s s :

D i v i s i o n of C o r p o r a t i o n s

R e g i s t r a t i o n S e c t i o n

P.O. B o x 6 3 2 7

T a l l a h a s s e e ,

FL 3 2 3 1 4

I n t e r n e t

A d d r e s s :

h t t p : / / w w w . s u n b i z . o r g

C o u r i e r

A d d r e s s :

D i v i s i o n of C o r p o r a t i o n s

R e g i s t r a t i o n S e c t i o n

4 0 9 E. G a i n e s S t r e e t

T a l l a h a s s e e ,

FL 3 2 3 9 9

Phone: (850) 487-6051

Hearing/Voice Impaired may call (850) 487-6096 (TDD)

INFORMATION REGARDING RETURNED CHECK

If the check submitted with this report is returned by a bank for any reason, the report will be cancelled and considered not filed. The Department of State will dissolve/revoke

the entity if a replacement payment with service charge and report are not resubmitted within the prescribed time frame.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1