Estimate Of Quarterly Tax Due Form - Division Of Taxation City Of Parma

ADVERTISEMENT

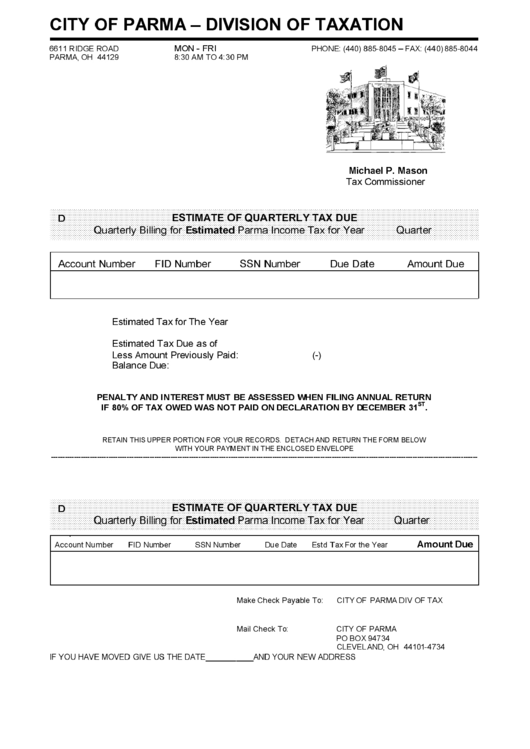

CITY OF PARMA DIVISION OF TAXATION

6611 RIDGE ROAD

PHONE: (440) 885-8045 FAX: (440) 885-8044

MON - FRI

PARMA, OH 44129

8:30 AM TO 4:30 PM

Michael P. Mason

Tax Commissioner

ESTIMATE OF QUARTERLY TAX DUE

D

Estimated

Quarterly Billing for

Parma Income Tax for Year

Quarter

Account Number

FID Number

SSN Number

Due Date

Amount Due

Estimated Tax for The Year

Estimated Tax Due as of

Less Amount Previously Paid:

(-)

Balance Due:

PENALTY AND INTEREST MUST BE ASSESSED WHEN FILING ANNUAL RETURN

IF 80% OF TAX OWED WAS NOT PAID ON DECLARATION BY DECEMBER 31 .

ST

RETAIN THIS UPPER PORTION FOR YOUR RECORDS. DETACH AND RETURN THE FORM BELOW

WITH YOUR PAYMENT IN THE ENCLOSED ENVELOPE

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

ESTIMATE OF QUARTERLY TAX DUE

D

Estimated

Quarterly Billing for

Parma Income Tax for Year

Quarter

.

Amount Due

Account Number

FID Number

SSN Number

Due Date

Estd Tax For the Year

Make Check Payable To:

CITY OF PARMA DIV OF TAX

Mail Check To:

CITY OF PARMA

PO BOX 94734

CLEVELAND, OH 44101-4734

IF YOU HAVE MOVED GIVE US THE DATE___________AND YOUR NEW ADDRESS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1