Business And Occupation Tax Report Form

ADVERTISEMENT

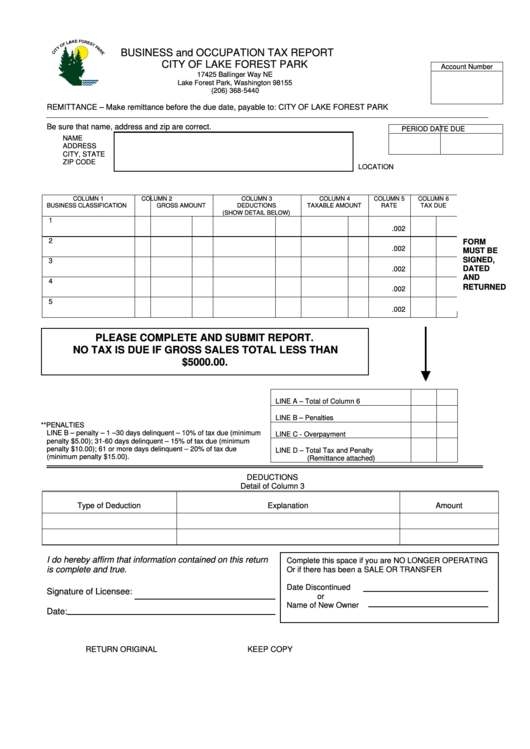

BUSINESS and OCCUPATION TAX REPORT

CITY OF LAKE FOREST PARK

Account Number

17425 Ballinger Way NE

Lake Forest Park, Washington 98155

(206) 368-5440

REMITTANCE – Make remittance before the due date, payable to: CITY OF LAKE FOREST PARK

Be sure that name, address and zip are correct.

PERIOD

DATE DUE

NAME

ADDRESS

CITY, STATE

ZIP CODE

LOCATION

COLUMN 1

COLUMN 2

COLUMN 3

COLUMN 4

COLUMN 5

COLUMN 6

BUSINESS CLASSIFICATION

GROSS AMOUNT

DEDUCTIONS

TAXABLE AMOUNT

RATE

TAX DUE

(SHOW DETAIL BELOW)

1

.002

2

FORM

.002

MUST BE

SIGNED,

3

DATED

.002

AND

4

RETURNED

.002

5

.002

PLEASE COMPLETE AND SUBMIT REPORT.

NO TAX IS DUE IF GROSS SALES TOTAL LESS THAN

$5000.00.

LINE A – Total of Column 6

LINE B – Penalties

**PENALTIES

LINE B – penalty – 1 –30 days delinquent – 10% of tax due (minimum

LINE C - Overpayment

penalty $5.00); 31-60 days delinquent – 15% of tax due (minimum

penalty $10.00); 61 or more days delinquent – 20% of tax due

LINE D – Total Tax and Penalty

(minimum penalty $15.00).

(Remittance attached)

DEDUCTIONS

Detail of Column 3

Type of Deduction

Explanation

Amount

I do hereby affirm that information contained on this return

Complete this space if you are NO LONGER OPERATING

is complete and true.

Or if there has been a SALE OR TRANSFER

Date Discontinued

Signature of Licensee:

or

Name of New Owner

Date:

RETURN ORIGINAL

KEEP COPY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1