Clear Form

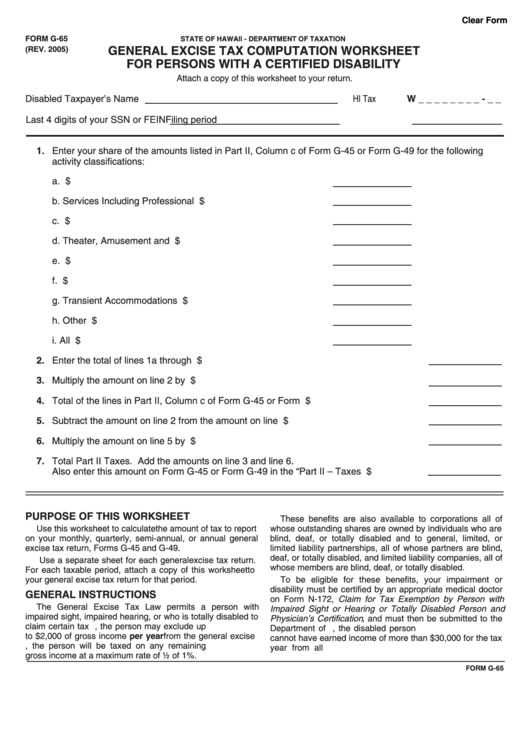

FORM G-65

STATE OF HAWAII - DEPARTMENT OF TAXATION

(REV. 2005)

GENERAL EXCISE TAX COMPUTATION WORKSHEET

FOR PERSONS WITH A CERTIFIED DISABILITY

Attach a copy of this worksheet to your return.

Disabled Taxpayer’s Name

HI Tax I.D. No. W _ _ _ _ _ _ _ _ - _ _

Last 4 digits of your SSN or FEIN

Filing period

1. Enter your share of the amounts listed in Part II, Column c of Form G-45 or Form G-49 for the following

activity classifications:

a. Retailing .................................................................................

$

b. Services Including Professional .............................................

$

c. Contracting .............................................................................

$

d. Theater, Amusement and Broadcasting .................................

$

e. Interest ...................................................................................

$

f. Commissions...........................................................................

$

g. Transient Accommodations Rentals.......................................

$

h. Other Rentals .........................................................................

$

i. All Others.................................................................................

$

2. Enter the total of lines 1a through 1i ..............................................................................

$

3. Multiply the amount on line 2 by .005 ............................................................................

$

4. Total of the lines in Part II, Column c of Form G-45 or Form G-49................................

$

5. Subtract the amount on line 2 from the amount on line 4 ..............................................

$

6. Multiply the amount on line 5 by .04 ..............................................................................

$

7. Total Part II Taxes. Add the amounts on line 3 and line 6.

Also enter this amount on Form G-45 or Form G-49 in the “Part II – Taxes box. ..........

$

PURPOSE OF THIS WORKSHEET

These benefits are also available to corporations all of

Use this worksheet to calculate the amount of tax to report

whose outstanding shares are owned by individuals who are

on your monthly, quarterly, semi-annual, or annual general

blind, deaf, or totally disabled and to general, limited, or

excise tax return, Forms G-45 and G-49.

limited liability partnerships, all of whose partners are blind,

deaf, or totally disabled, and limited liability companies, all of

Use a separate sheet for each general excise tax return.

whose members are blind, deaf, or totally disabled.

For each taxable period, attach a copy of this worksheet to

your general excise tax return for that period.

To be eligible for these benefits, your impairment or

disability must be certified by an appropriate medical doctor

GENERAL INSTRUCTIONS

on Form N-172, Claim for Tax Exemption by Person with

The General Excise Tax Law permits a person with

Impaired Sight or Hearing or Totally Disabled Person and

impaired sight, impaired hearing, or who is totally disabled to

Physician’s Certification , and must then be submitted to the

claim certain tax benefits. First, the person may exclude up

Department of Taxation. Furthermore, the disabled person

to $2,000 of gross income per year from the general excise

cannot have earned income of more than $30,000 for the tax

tax. Second, the person will be taxed on any remaining

year from all sources.

For more information on earned

gross income at a maximum rate of ½ of 1%.

FORM G-65

1

1