Form Dmf -10 - Distributor Of Motor Fuels Tax Return

ADVERTISEMENT

Division use only — DLN Stamp

Division use only — Date Stamp

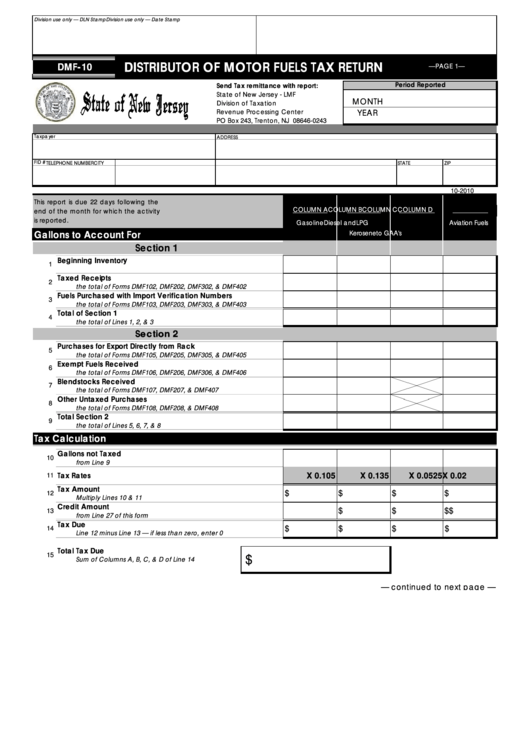

DISTRIBUTOR OF MOTOR FUELS TAX RETURN

DMF-10

—PAGE 1—

Period Reported

Send Tax remittance with report:

State of New Jersey - LMF

MONTH

Division of Taxation

Revenue Processing Center

YEAR

PO Box 243, Trenton, NJ 08646-0243

Taxpayer

ADDRESS

FID #

TELEPHONE NUMBER

CITY

STATE

ZIP

10-2010

This report is due 22 days following the

COLUMN A

COLUMN B

COLUMN C

COLUMN D

end of the month for which the activity

is reported.

Gasoline

Diesel and

LPG

Aviation Fuels

Gallons to Account For

Kerosene

to GAA's

Section 1

Beginning Inventory

1

Taxed Receipts

2

the total of Forms DMF102, DMF202, DMF302, & DMF402

Fuels Purchased with Import Verification Numbers

3

the total of Forms DMF103, DMF203, DMF303, & DMF403

Total of Section 1

4

the total of Lines 1, 2, & 3

Section 2

Section 2

Purchases for Export Directly from Rack

5

the total of Forms DMF105, DMF205, DMF305, & DMF405

Exempt Fuels Received

6

the total of Forms DMF106, DMF206, DMF306, & DMF406

Blendstocks Received

7

the total of Forms DMF107, DMF207, & DMF407

Other Untaxed Purchases

8

the total of Forms DMF108, DMF208, & DMF408

Total Section 2

9

the total of Lines 5, 6, 7, & 8

Tax Calculation

Gallons not Taxed

10

from Line 9

X 0.105

X 0.135

X 0.0525

X 0.02

Tax Rates

11

Tax Amount

$

$

$

$

12

Multiply Lines 10 & 11

Credit Amount

$

$

$

$

13

from Line 27 of this form

Tax Due

$

$

$

$

14

Line 12 minus Line 13 — if less than zero, enter 0

Total Tax Due

15

$

Sum of Columns A, B, C, & D of Line 14

— continued to next page —

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44