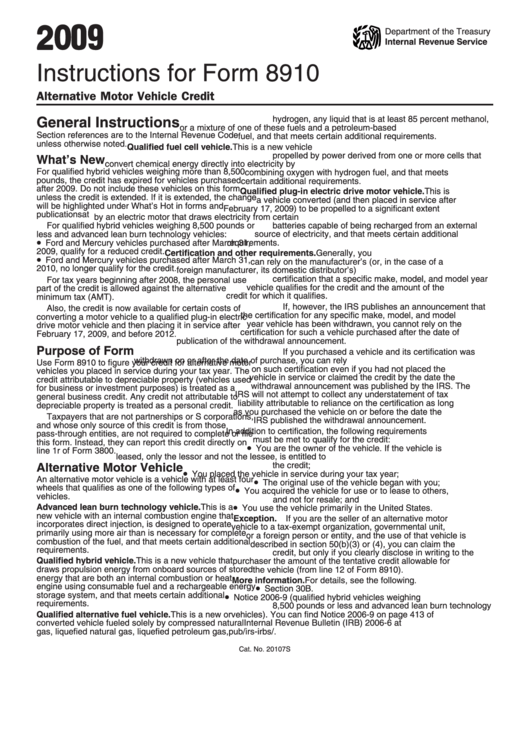

Instructions For Form 8910 - 2009

ADVERTISEMENT

2 0 09

Department of the Treasury

Internal Revenue Service

Instructions for Form 8910

Alternative Motor Vehicle Credit

hydrogen, any liquid that is at least 85 percent methanol,

General Instructions

or a mixture of one of these fuels and a petroleum-based

Section references are to the Internal Revenue Code

fuel, and that meets certain additional requirements.

unless otherwise noted.

Qualified fuel cell vehicle. This is a new vehicle

propelled by power derived from one or more cells that

What’s New

convert chemical energy directly into electricity by

For qualified hybrid vehicles weighing more than 8,500

combining oxygen with hydrogen fuel, and that meets

pounds, the credit has expired for vehicles purchased

certain additional requirements.

after 2009. Do not include these vehicles on this form

Qualified plug-in electric drive motor vehicle. This is

unless the credit is extended. If it is extended, the change

a vehicle converted (and then placed in service after

will be highlighted under What’s Hot in forms and

February 17, 2009) to be propelled to a significant extent

publications at

by an electric motor that draws electricity from certain

For qualified hybrid vehicles weighing 8,500 pounds or

batteries capable of being recharged from an external

source of electricity, and that meets certain additional

less and advanced lean burn technology vehicles:

•

Ford and Mercury vehicles purchased after March 31,

requirements.

2009, qualify for a reduced credit.

Certification and other requirements. Generally, you

•

Ford and Mercury vehicles purchased after March 31,

can rely on the manufacturer’s (or, in the case of a

2010, no longer qualify for the credit.

foreign manufacturer, its domestic distributor’s)

certification that a specific make, model, and model year

For tax years beginning after 2008, the personal use

vehicle qualifies for the credit and the amount of the

part of the credit is allowed against the alternative

credit for which it qualifies.

minimum tax (AMT).

If, however, the IRS publishes an announcement that

Also, the credit is now available for certain costs of

the certification for any specific make, model, and model

converting a motor vehicle to a qualified plug-in electric

year vehicle has been withdrawn, you cannot rely on the

drive motor vehicle and then placing it in service after

certification for such a vehicle purchased after the date of

February 17, 2009, and before 2012.

publication of the withdrawal announcement.

Purpose of Form

If you purchased a vehicle and its certification was

withdrawn on or after the date of purchase, you can rely

Use Form 8910 to figure your credit for alternative motor

on such certification even if you had not placed the

vehicles you placed in service during your tax year. The

vehicle in service or claimed the credit by the date the

credit attributable to depreciable property (vehicles used

withdrawal announcement was published by the IRS. The

for business or investment purposes) is treated as a

IRS will not attempt to collect any understatement of tax

general business credit. Any credit not attributable to

liability attributable to reliance on the certification as long

depreciable property is treated as a personal credit.

as you purchased the vehicle on or before the date the

Taxpayers that are not partnerships or S corporations,

IRS published the withdrawal announcement.

and whose only source of this credit is from those

In addition to certification, the following requirements

pass-through entities, are not required to complete or file

must be met to qualify for the credit:

this form. Instead, they can report this credit directly on

•

You are the owner of the vehicle. If the vehicle is

line 1r of Form 3800.

leased, only the lessor and not the lessee, is entitled to

the credit;

Alternative Motor Vehicle

•

You placed the vehicle in service during your tax year;

•

An alternative motor vehicle is a vehicle with at least four

The original use of the vehicle began with you;

•

wheels that qualifies as one of the following types of

You acquired the vehicle for use or to lease to others,

vehicles.

and not for resale; and

•

Advanced lean burn technology vehicle. This is a

You use the vehicle primarily in the United States.

new vehicle with an internal combustion engine that

Exception. If you are the seller of an alternative motor

incorporates direct injection, is designed to operate

vehicle to a tax-exempt organization, governmental unit,

primarily using more air than is necessary for complete

or a foreign person or entity, and the use of that vehicle is

combustion of the fuel, and that meets certain additional

described in section 50(b)(3) or (4), you can claim the

requirements.

credit, but only if you clearly disclose in writing to the

Qualified hybrid vehicle. This is a new vehicle that

purchaser the amount of the tentative credit allowable for

draws propulsion energy from onboard sources of stored

the vehicle (from line 12 of Form 8910).

energy that are both an internal combustion or heat

More information. For details, see the following.

•

engine using consumable fuel and a rechargeable energy

Section 30B.

•

storage system, and that meets certain additional

Notice 2006-9 (qualified hybrid vehicles weighing

requirements.

8,500 pounds or less and advanced lean burn technology

Qualified alternative fuel vehicle. This is a new or

vehicles). You can find Notice 2006-9 on page 413 of

converted vehicle fueled solely by compressed natural

Internal Revenue Bulletin (IRB) 2006-6 at

gas, liquefied natural gas, liquefied petroleum gas,

pub/irs-irbs/irb06-06.pdf.

Cat. No. 20107S

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4