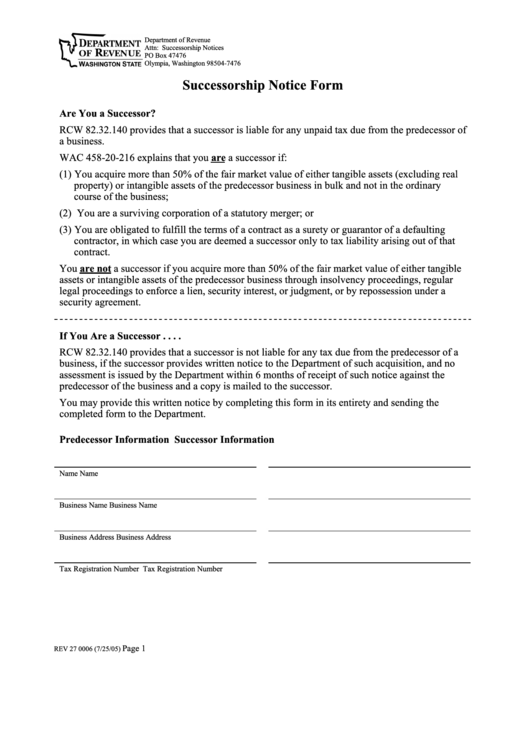

Successorship Notice Form

ADVERTISEMENT

Department of Revenue

Attn: Successorship Notices

PO Box 47476

Olympia, Washington 98504-7476

Successorship Notice Form

Are You a Successor?

RCW 82.32.140 provides that a successor is liable for any unpaid tax due from the predecessor of

a business.

WAC 458-20-216 explains that you are a successor if:

(1) You acquire more than 50% of the fair market value of either tangible assets (excluding real

property) or intangible assets of the predecessor business in bulk and not in the ordinary

course of the business;

(2) You are a surviving corporation of a statutory merger; or

(3) You are obligated to fulfill the terms of a contract as a surety or guarantor of a defaulting

contractor, in which case you are deemed a successor only to tax liability arising out of that

contract.

You are not a successor if you acquire more than 50% of the fair market value of either tangible

assets or intangible assets of the predecessor business through insolvency proceedings, regular

legal proceedings to enforce a lien, security interest, or judgment, or by repossession under a

security agreement.

If You Are a Successor . . . .

RCW 82.32.140 provides that a successor is not liable for any tax due from the predecessor of a

business, if the successor provides written notice to the Department of such acquisition, and no

assessment is issued by the Department within 6 months of receipt of such notice against the

predecessor of the business and a copy is mailed to the successor.

You may provide this written notice by completing this form in its entirety and sending the

completed form to the Department.

Predecessor Information

Successor Information

Name

Name

Business Name

Business Name

Business Address

Business Address

Tax Registration Number

Tax Registration Number

Page 1

REV 27 0006 (7/25/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2