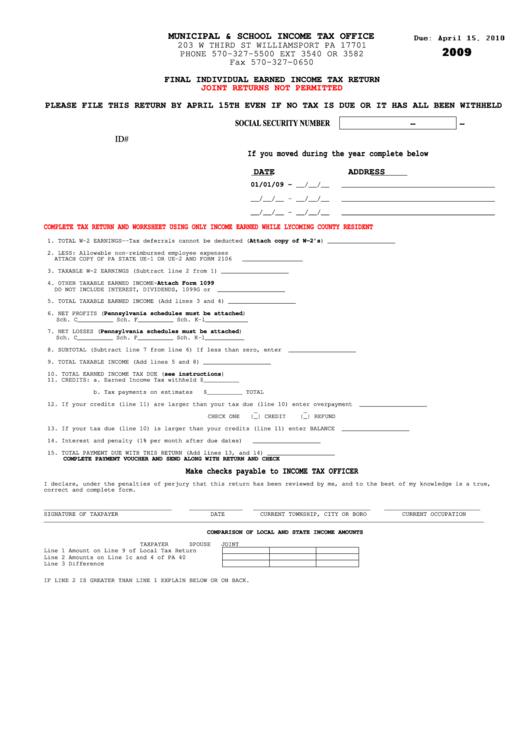

Final Individual Earned Income Tax Return - 2009

ADVERTISEMENT

MUNICIPAL & SCHOOL INCOME TAX OFFICE

203 W THIRD ST WILLIAMSPORT PA 17701

PHONE 570-327-5500 EXT 3540 OR 3582

Fax 570-327-0650

FINAL INDIVIDUAL EARNED INCOME TAX RETURN

JOINT RETURNS NOT PERMITTED

PLEASE FILE THIS RETURN BY APRIL 15TH EVEN IF NO TAX IS DUE OR IT HAS ALL BEEN WITHHELD

--

--

SOCIAL SECURITY NUMBER

ID#

If you moved during the year complete below

DATE

ADDRESS

01/01/09 - __/__/__

_____________________________________

__/__/__ - __/__/__

_____________________________________

__/__/__ - __/__/__

_____________________________________

COMPLETE TAX RETURN AND WORKSHEET USING ONLY INCOME EARNED WHILE LYCOMING COUNTY RESIDENT

1. TOTAL W-2 EARNINGS--Tax deferrals cannot be deducted (Attach copy of W-2’s)...............1. ___________________

2. LESS: Allowable non-reimbursed employee expenses

ATTACH COPY OF PA STATE UE-1 OR UE-2 AND FORM 2106

...............2. _________________

3. TAXABLE W-2 EARNINGS (Subtract line 2 from 1).............................................3. ___________________

4. OTHER TAXABLE EARNED INCOME-Attach Form 1099

DO NOT INCLUDE INTEREST, DIVIDENDS, 1099G or 1099B.........................................4. ___________________

5. TOTAL TAXABLE EARNED INCOME (Add lines 3 and 4)...........................................5. ___________________

6. NET PROFITS (Pennsylvania schedules must be attached)

Sch. C__________ Sch. F__________ Sch. K-1____________............6.__________________

7. NET LOSSES (Pennsylvania schedules must be attached)

Sch. C__________ Sch. F__________ Sch. K-1___________.............7.__________________

8. SUBTOTAL (Subtract line 7 from line 6) If less than zero, enter zero......................8. ___________________

9. TOTAL TAXABLE INCOME (Add lines 5 and 8)..................................................9. ___________________

10. TOTAL EARNED INCOME TAX DUE (see instructions).....................10.__________________

11. CREDITS: a. Earned Income Tax withheld $__________

b. Tax payments on estimates

$__________ TOTAL CREDITS...11.__________________

12. If your credits (line 11) are larger than your tax due (line 10) enter overpayment ......12. ___________________

_

_

CHECK ONE

|_| CREDIT

|_| REFUND

13. If your tax due (line 10) is larger than your credits (line 11) enter BALANCE DUE........13. ___________________

14. Interest and penalty (1% per month after due dates) ...................... ..............14. ___________________

15. TOTAL PAYMENT DUE WITH THIS RETURN (Add lines 13, and 14)................................16. ___________________

COMPLETE PAYMENT VOUCHER AND SEND ALONG WITH RETURN AND CHECK

Make checks payable to INCOME TAX OFFICER

I declare, under the penalties of perjury that this return has been reviewed by me, and to the best of my knowledge is a true,

correct and complete form.

____________________________________

_______________

_________________________________

___________________________

SIGNATURE OF TAXPAYER

DATE

CURRENT TOWNSHIP, CITY OR BORO

CURRENT OCCUPATION

____________________________________________________________________________________________________________________________

COMPARISON OF LOCAL AND STATE INCOME AMOUNTS

TAXPAYER

SPOUSE

JOINT

Line 1 Amount on Line 9 of Local Tax Return

Line 2 Amounts on Line 1c and 4 of PA 40

Line 3 Difference

IF LINE 2 IS GREATER THAN LINE 1 EXPLAIN BELOW OR ON BACK.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1