Form 10 And Instructions For Underpayment Of Estimated Tax - 2005

ADVERTISEMENT

2005

OREGON

Form 10 and Instructions for

Underpayment of Estimated Tax

General Information

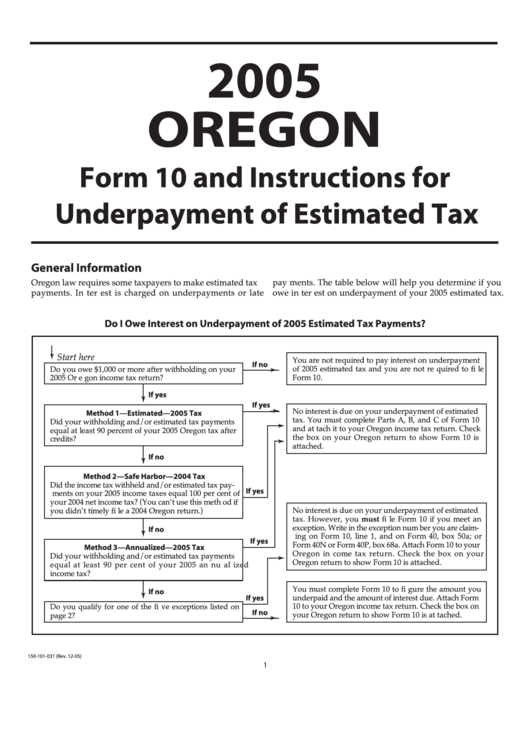

Oregon law requires some taxpayers to make estimated tax

pay ments. The table below will help you determine if you

payments. In ter est is charged on underpayments or late

owe in ter est on underpayment of your 2005 estimated tax.

Do I Owe Interest on Underpayment of 2005 Estimated Tax Payments?

Start here

You are not required to pay interest on underpayment

If no

➛

of 2005 estimated tax and you are not re quired to fi le

Do you owe $1,000 or more after withholding on your

2005 Or e gon income tax return?

Form 10.

If yes

If yes

➛

No interest is due on your underpayment of estimated

Method 1—Estimated—2005 Tax

tax. You must complete Parts A, B, and C of Form 10

Did your withholding and/or estimated tax payments

➛

and at tach it to your Oregon income tax return. Check

equal at least 90 percent of your 2005 Oregon tax after

the box on your Oregon return to show Form 10 is

credits?

➛

at tached.

If no

Method 2—Safe Harbor—2004 Tax

Did the income tax withheld and/or estimated tax pay-

If yes

ments on your 2005 income taxes equal 100 per cent of

your 2004 net income tax? (You can’t use this meth od if

No interest is due on your underpayment of estimated

you didn’t timely fi le a 2004 Oregon return.)

tax. However, you must fi le Form 10 if you meet an

exception. Write in the exception num ber you are claim-

If no

ing on Form 10, line 1, and on Form 40, box 50a; or

If yes

Form 40N or Form 40P, box 68a. Attach Form 10 to your

Method 3—Annualized—2005 Tax

Oregon in come tax return. Check the box on your

Did your withholding and/or estimated tax payments

➛

Oregon return to show Form 10 is attached.

equal at least 90 per cent of your 2005 an nu al ized

income tax?

You must complete Form 10 to fi gure the amount you

If no

underpaid and the amount of interest due. Attach Form

If yes

Do you qualify for one of the fi ve exceptions listed on

10 to your Oregon income tax return. Check the box on

If no

your Oregon return to show Form 10 is at tached.

page 2?

➛

150-101-031 (Rev. 12-05)

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6