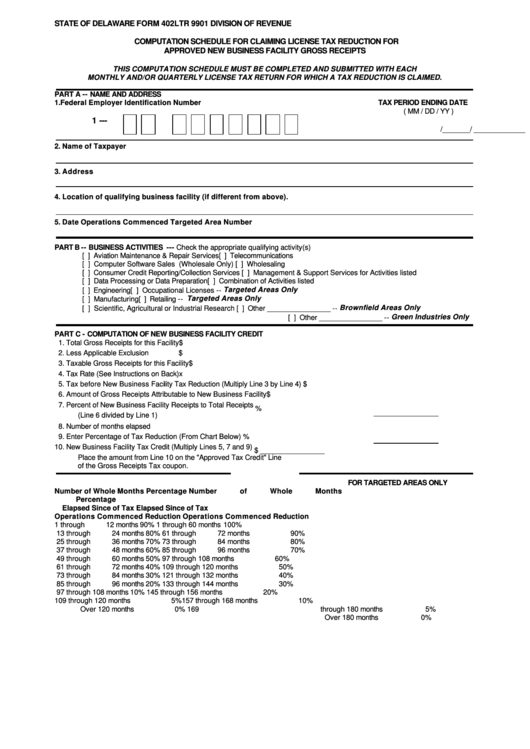

STATE OF DELAWARE

FORM 402LTR 9901

DIVISION OF REVENUE

COMPUTATION SCHEDULE FOR CLAIMING LICENSE TAX REDUCTION FOR

Reset

APPROVED NEW BUSINESS FACILITY GROSS RECEIPTS

Print Form

THIS COMPUTATION SCHEDULE MUST BE COMPLETED AND SUBMITTED WITH EACH

MONTHLY AND/OR QUARTERLY LICENSE TAX RETURN FOR WHICH A TAX REDUCTION IS CLAIMED.

PART A -- NAME AND ADDRESS

1. Federal Employer Identification Number

TAX PERIOD ENDING DATE

( MM / DD / YY )

1 --

______

/ _______

/_______

2. Name of Taxpayer

3. Address

4. Location of qualifying business facility (if different from above).

5. Date Operations Commenced

Targeted Area Number

PART B -- BUSINESS ACTIVITIES --- Check the appropriate qualifying activity(s)

[ ] Aviation Maintenance & Repair Services

[ ] Telecommunications

[ ] Computer Software Sales (Wholesale Only)

[ ] Wholesaling

[ ] Consumer Credit Reporting/Collection Services

[ ] Management & Support Services for Activities listed

[ ] Data Processing or Data Preparation

[ ] Combination of Activities listed

[ ] Occupational Licenses -- Targeted Areas Only

[ ] Engineering

[ ] Retailing -- Targeted Areas Only

[ ] Manufacturing

[ ] Other ________________ -- Brownfield Areas Only

[ ] Scientific, Agricultural or Industrial Research

[ ] Other ________________ -- Green Industries Only

PART C - COMPUTATION OF NEW BUSINESS FACILITY CREDIT

1.

Total Gross Receipts for this Facility

$

2.

Less Applicable Exclusion

$

3.

Taxable Gross Receipts for this Facility

$

4.

Tax Rate (See Instructions on Back)

x

5.

Tax before New Business Facility Tax Reduction (Multiply Line 3 by Line 4)

$

6.

Amount of Gross Receipts Attributable to New Business Facility

$

7.

Percent of New Business Facility Receipts to Total Receipts

%

(Line 6 divided by Line 1)

8.

Number of months elapsed

9.

Enter Percentage of Tax Reduction (From Chart Below)

%

10.

New Business Facility Tax Credit (Multiply Lines 5, 7 and 9)

$

________________

Place the amount from Line 10 on the "Approved Tax Credit" Line

of the Gross Receipts Tax coupon.

FOR TARGETED AREAS ONLY

Number of Wh ole Months

Percentage

Number

of

Whole

Months

Percentage

Elapsed Since

of Tax

Elapsed Since

of Tax

Operations Commenced

Reduction

Operations Commenced

Reduction

1

through

12

months

90%

1

through

60

months

100%

13

through

24

months

80%

61

through

72

months

90%

25

through

36

months

70%

73

through

84

months

80%

37

through

48

months

60%

85

through

96

months

70%

49

through

60

months

50%

97

through

108

months

60%

61

through

72

months

40%

109

through

120

months

50%

73

through

84

months

30%

121

through

132

months

40%

85

through

96

months

20%

133

through

144

months

30%

97

through

108

months

10%

145

through

156

months

20%

109

through

120

months

5%

157

through

168

months

10%

Over

120

months

0%

169

through

180

months

5%

Over

180

months

0%

1

1 2

2