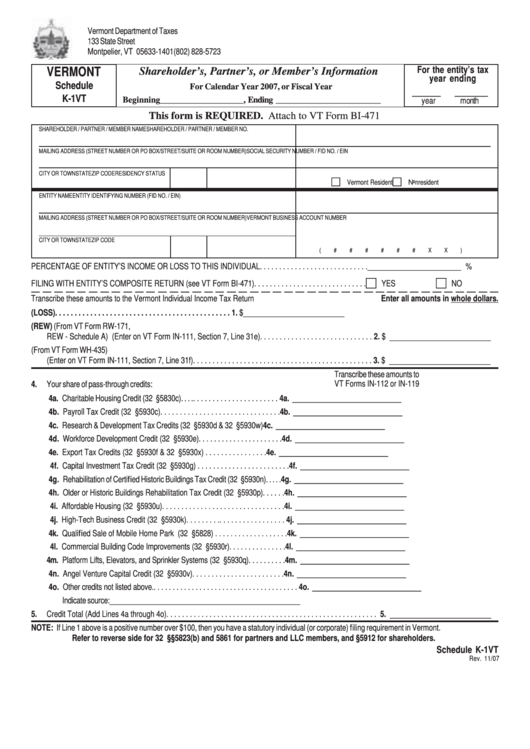

Schedule K-1vt - Shareholder'S, Partner'S, Or Member'S Information

ADVERTISEMENT

Vermont Department of Taxes

133 State Street

Montpelier, VT 05633-1401

(802) 828-5723

For the entity’s tax

VERMONT

Shareholder’s, Partner’s, or Member’s Information

year ending

Schedule

For Calendar Year 2007, or Fiscal Year

______

_______

K-1VT

Beginning ___________________ , Ending ________________________

year

month

This form is REQUIRED. Attach to VT Form BI-471

SHAREHOLDER / PARTNER / MEMBER NAME

SHAREHOLDER / PARTNER / MEMBER NO.

MAILING ADDRESS (STREET NUMBER OR PO BOX/STREET/SUITE OR ROOM NUMBER)

SOCIAL SECURITY NUMBER / FID NO. / EIN

CITY OR TOWN

STATE

ZIP CODE

RESIDENCY STATUS

Vermont Resident

Nonresident

ENTITY NAME

ENTITY IDENTIFYING NUMBER (FID NO. / EIN)

MAILING ADDRESS (STREET NUMBER OR PO BOX/STREET/SUITE OR ROOM NUMBER)

VERMONT BUSINESS ACCOUNT NUMBER

CITY OR TOWN

STATE

ZIP CODE

(#

#

#

#

#

#

X

X)

PERCENTAGE OF ENTITY’S INCOME OR LOSS TO THIS INDIVIDUAL . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________ %

FILING WITH ENTITY’S COMPOSITE RETURN (see VT Form BI-471) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

Transcribe these amounts to the Vermont Individual Income Tax Return

Enter all amounts in whole dollars.

1.

SHARE OF VERMONT NET INCOME (LOSS) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. $ __________________________

2.

TOTAL TAXABLE YEAR REAL ESTATE WITHHOLDING (REW) (From VT Form RW-171,

REW - Schedule A) (Enter on VT Form IN-111, Section 7, Line 31e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. $ __________________________

3.

TOTAL TAXABLE YEAR NONRESIDENT ESTIMATED PAYMENTS (From VT Form WH-435)

(Enter on VT Form IN-111, Section 7, Line 31f) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. $ __________________________

Transcribe these amounts to

VT Forms IN-112 or IN-119

4.

Your share of pass-through credits:

4a. Charitable Housing Credit (32 V.S.A. §5830c) . . . . . . . . . . . . . . . . . . . . . . . . . . 4a. ____________________________

4b. Payroll Tax Credit (32 V.S.A. §5930c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4b. ____________________________

4c. Research & Development Tax Credits (32 V.S.A. §5930d & 32 V.S.A. §5930w) 4c. ____________________________

4d. Workforce Development Credit (32 V.S.A. §5930e) . . . . . . . . . . . . . . . . . . . . . . 4d. ____________________________

4e. Export Tax Credits (32 V.S.A. §5930f & 32 V.S.A. §5930x) . . . . . . . . . . . . . . . . 4e. ____________________________

4f. Capital Investment Tax Credit (32 V.S.A. §5930g) . . . . . . . . . . . . . . . . . . . . . . . . 4f. ____________________________

4g. Rehabilitation of Certified Historic Buildings Tax Credit (32 V.S.A. §5930n) . . . . . 4g. ____________________________

4h. Older or Historic Buildings Rehabilitation Tax Credit (32 V.S.A. §5930p) . . . . . . 4h. ____________________________

4i. Affordable Housing (32 V.S.A. §5930u) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4i. ____________________________

4j. High-Tech Business Credit (32 V.S.A. §5930k) . . . . . . . . . . . . . . . . . . . . . . . . . . 4j. ____________________________

4k. Qualified Sale of Mobile Home Park (32 V.S.A. §5828) . . . . . . . . . . . . . . . . . . . 4k. ____________________________

4l. Commercial Building Code Improvements (32 V.S.A. §5930r) . . . . . . . . . . . . . . . 4l. ____________________________

4m. Platform Lifts, Elevators, and Sprinkler Systems (32 V.S.A. §5930q) . . . . . . . . . . 4m. ____________________________

4n. Angel Venture Capital Credit (32 V.S.A. §5930v) . . . . . . . . . . . . . . . . . . . . . . . . 4n. ____________________________

4o. Other credits not listed above. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4o. ____________________________

Indicate source: _________________________________________________

5.

Credit Total (Add Lines 4a through 4o) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. __________________________

NOTE: If Line 1 above is a positive number over $100, then you have a statutory individual (or corporate) filing requirement in Vermont.

Refer to reverse side for 32 V.S.A. §§5823(b) and 5861 for partners and LLC members, and §5912 for shareholders.

Schedule K-1VT

Rev. 11/07

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1