Instructions For Form Ow-9-Mse - Annual Withholding Tax Exemption Certification For Military Spouse - 2012

ADVERTISEMENT

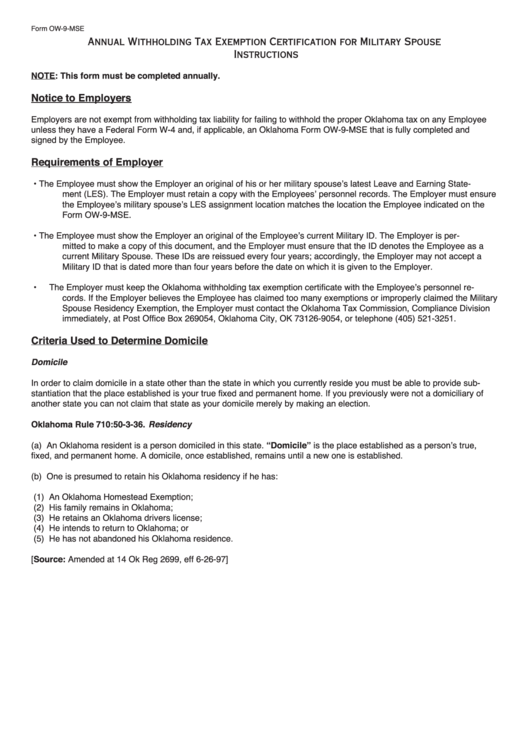

Form OW-9-MSE

Annual Withholding Tax Exemption Certification for Military Spouse

Instructions

NOTE: This form must be completed annually.

Notice to Employers

Employers are not exempt from withholding tax liability for failing to withhold the proper Oklahoma tax on any Employee

unless they have a Federal Form W-4 and, if applicable, an Oklahoma Form OW-9-MSE that is fully completed and

signed by the Employee.

Requirements of Employer

•

The Employee must show the Employer an original of his or her military spouse’s latest Leave and Earning State-

ment (LES). The Employer must retain a copy with the Employees’ personnel records. The Employer must ensure

the Employee’s military spouse’s LES assignment location matches the location the Employee indicated on the

Form OW-9-MSE.

•

The Employee must show the Employer an original of the Employee’s current Military ID. The Employer is per-

mitted to make a copy of this document, and the Employer must ensure that the ID denotes the Employee as a

current Military Spouse. These IDs are reissued every four years; accordingly, the Employer may not accept a

Military ID that is dated more than four years before the date on which it is given to the Employer.

•

The Employer must keep the Oklahoma withholding tax exemption certificate with the Employee’s personnel re-

cords. If the Employer believes the Employee has claimed too many exemptions or improperly claimed the Military

Spouse Residency Exemption, the Employer must contact the Oklahoma Tax Commission, Compliance Division

immediately, at Post Office Box 269054, Oklahoma City, OK 73126-9054, or telephone (405) 521-3251.

Criteria Used to Determine Domicile

Domicile

In order to claim domicile in a state other than the state in which you currently reside you must be able to provide sub-

stantiation that the place established is your true fixed and permanent home. If you previously were not a domiciliary of

another state you can not claim that state as your domicile merely by making an election.

Oklahoma Rule 710:50-3-36. Residency

(a) An Oklahoma resident is a person domiciled in this state. “Domicile” is the place established as a person’s true,

fixed, and permanent home. A domicile, once established, remains until a new one is established.

(b) One is presumed to retain his Oklahoma residency if he has:

(1) An Oklahoma Homestead Exemption;

(2) His family remains in Oklahoma;

(3) He retains an Oklahoma drivers license;

(4) He intends to return to Oklahoma; or

(5) He has not abandoned his Oklahoma residence.

[Source: Amended at 14 Ok Reg 2699, eff 6-26-97]

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5